For the 24 hours to 23:00 GMT, USD strengthened 0.19% against the JPY and closed at 80.25, on poor Japanese trade data.

In Japan, yesterday, the leading index fell to 96.2 in April from 96.4 in March. Meanwhile, the coincident index was revised lower to 103.6 from 103.8 initially reported for April. Additionally, the convenience store sales, on a same-store basis, rose by 5.7% annually to ¥656.7 billion in May.

The Japanese government raised its assessment of the economy as production and exports gave signs of recovering. Additionally, the Cabinet Office stated that “upward movements have been observed in the Japanese economy, while difficulties continue to prevail” due to the disaster.

In the Asian session at 3:00GMT, the pair is trading lower from yesterday’s close at 23:00 GMT, by 0.10%, at 80.17.

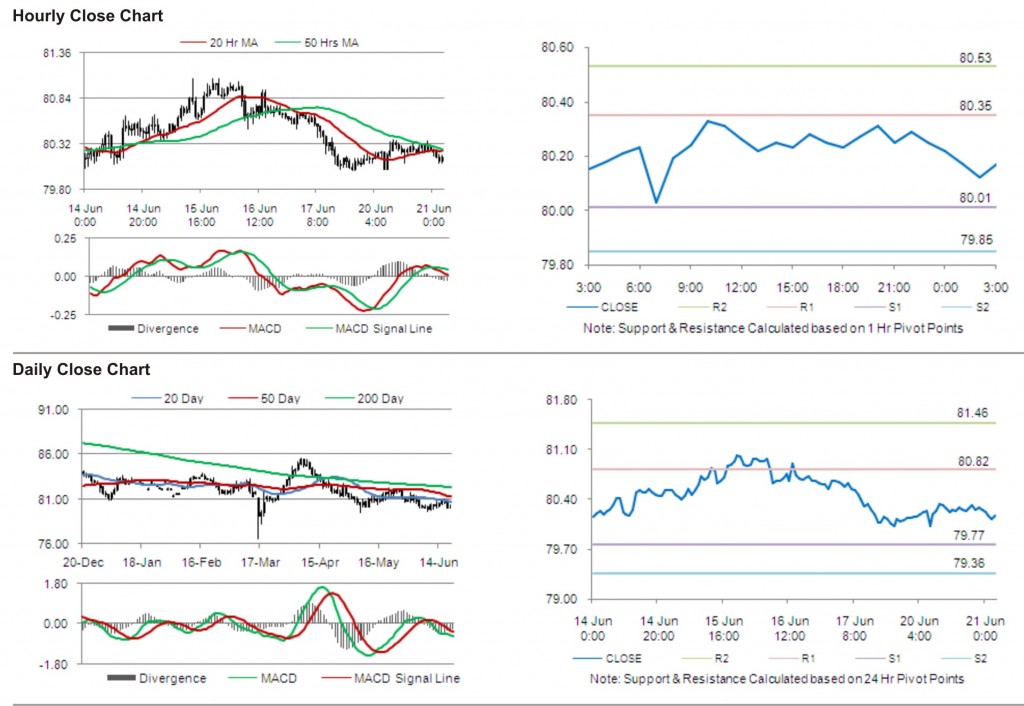

The first short term resistance is at 80.35, followed by 80.53. The pair is expected to find support at 80.01 and the subsequent support level at 79.85.

Trading trends in the pair today are expected to be determined by release of all industry activity index in Japan.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.