For the 24 hours to 23:00 GMT, the EUR rose 0.16% against the USD and closed at 1.0446 on Friday, after the Euro-zone’s final consumer price index (CPI) rose 0.6% YoY in November, at par with market expectations. In the prior month, the CPI had registered a rise of 0.5%, while the preliminary figures had recorded a revised advance of 0.5%. On the contrary, consumer prices dropped 0.1% on a monthly basis in November, at par with market expectations and following a rise of 0.2% in the previous month. Additionally, the region’s seasonally adjusted trade surplus surprisingly narrowed to a level of €19.7 billion in October, declining to its lowest level in eight months as exports fell and imports rose. The region posted a revised trade surplus of €24.4 billion in the previous month, whereas markets anticipated the region’s trade surplus to widen to a level of €24.5 billion.

On the data front, the US housing starts dropped more-than-expected by 18.7% on a monthly basis, to an annual rate of 1090.0K in November. Markets were anticipating housing starts to ease to a level of 1230.0K, compared to a revised level of 1340.0K in the previous month. Moreover, the nation’s building permits eased 4.7% on a monthly basis, to an annual rate of 1201.0K in November, compared to a revised reading of 1260.0K in the previous month and surpassing investor consensus for it to ease to a level of 1240.0K.

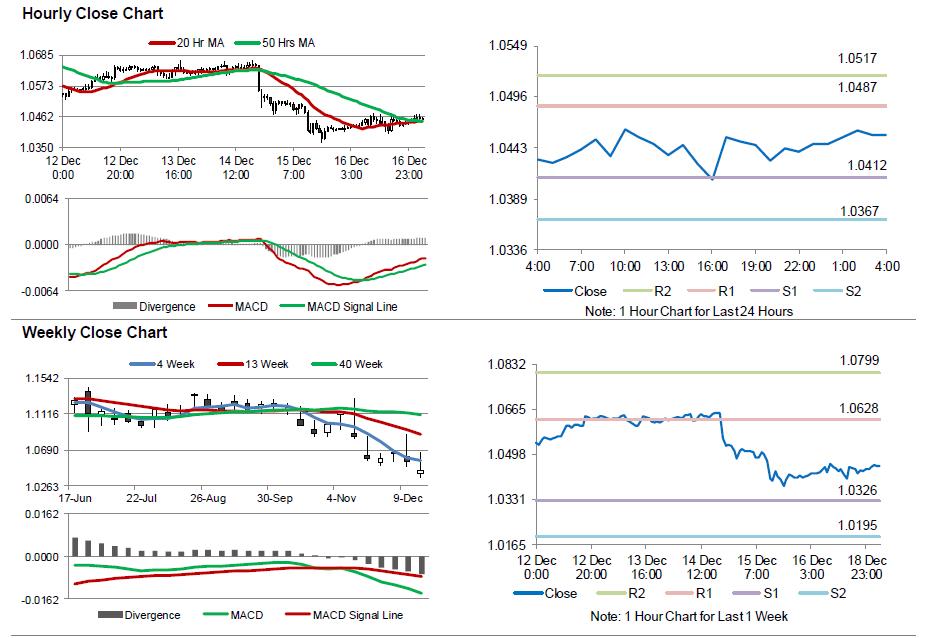

In the Asian session, at GMT0400, the pair is trading at 1.0456, with the EUR trading 0.1% higher against the USD from Friday’s close.

The pair is expected to find support at 1.0412, and a fall through could take it to the next support level of 1.0367. The pair is expected to find its first resistance at 1.0487, and a rise through could take it to the next resistance level of 1.0517.

Moving ahead, market participants will look forward to Germany’s Ifo expectations index for December and the Euro-zone’s construction output for October, scheduled to release in a few hours. Additionally, the US flash Markit services PMI for December, slated to release later today will attract significant amount of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.