For the 24 hours to 23:00 GMT, the EUR declined 0.1% against the USD and closed at 1.0668.

On the data front, the Euro-zone’s final Markit services PMI surprisingly dropped to a level of 56.0 in March, from a level of 56.5 recorded in the preliminary print. In the prior month, the PMI had registered a reading of 55.5.

Separately, activity in Germany’s services sector was confirmed at a fifteen-month high level of 55.6 in March, compared to a level of 54.4 registered in the previous month.

In the US, minutes of the Federal Reserve’s (Fed) March meeting revealed that the central bank is on course to begin reducing its $4.5 trillion balance sheet later this year if economic data holds up. Further, minutes also revealed that policymakers judged that the labour market continues to strengthen and the economic outlook hasn’t changed much since January.

The US Dollar climbed earlier in the session, on the back of robust ADP jobs report in the US.

Data revealed that the US ADP private sector employment increased more-than-anticipated by 263.0K in March, adding the most number of workers in over two years, thus suggesting that the nation’s job growth is off to a strong start in 2017. The private sector employment had recorded a revised gain of 245.0K in the prior month, compared to market expectations of an advance of 185.0K

On the contrary, the nation’s ISM non-manufacturing PMI declined more-than-expected to a level of 55.2 in March, hitting its lowest level in five months, while investors had envisaged a decline to a level 57.0. The non-manufacturing PMI had recorded a reading of 57.6 in the previous month. Additionally, the nation’s final Markit services PMI was revised lower to a level of 52.8 in March, compared to a fall to a level of 52.9 registered in the flash estimate. In the previous month, the PMI had registered a level of 53.8. Further, the nation’s mortgage applications eased 1.6% in the week ended 31 March 2017, after recording a fall of 0.8% in the prior week.

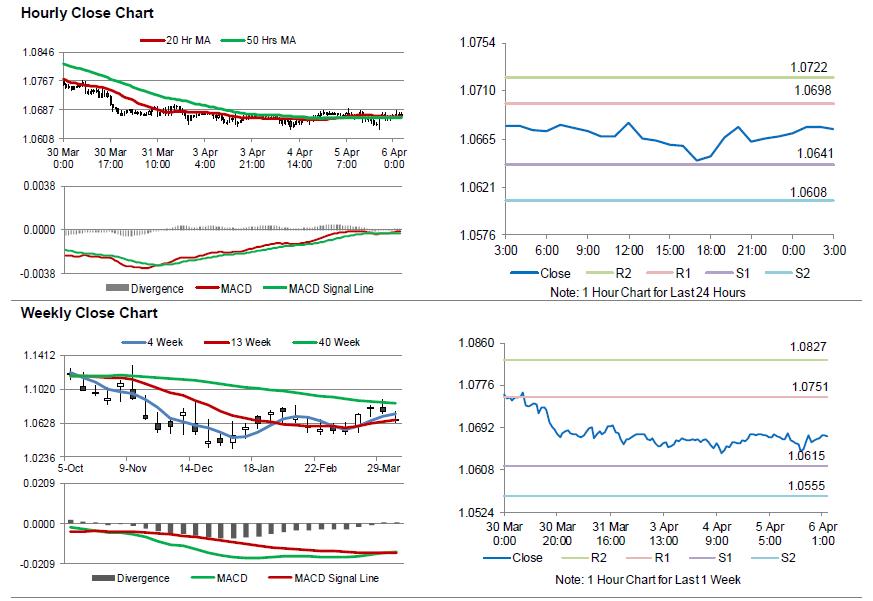

In the Asian session, at GMT0300, the pair is trading at 1.0674, with the EUR trading 0.06% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0641, and a fall through could take it to the next support level of 1.0608. The pair is expected to find its first resistance at 1.0698, and a rise through could take it to the next resistance level of 1.0722.

Going ahead, investors will look forward to the minutes of the European Central Bank’s (ECB) recent meeting along with Germany’s factory orders for February, slated to release in a few hours. Additionally, the US weekly jobless claims data will also be on investors radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.