For the 24 hours to 23:00 GMT, USD declined 0.37% against the CAD to close at 0.9854.

The Canadian dollar strengthened yesterday, as new developments in Europe helped ease fears of a Greek government debt default. France offered a solution for banks to roll over holdings of Greek debt for 30 years, while the Greek government fought to get back-bench rebels to back a crucial austerity plan to avert bankruptcy.

In the US, the Federal Reserve Bank of Dallas, in its Texas manufacturing outlook survey, reported that its production index fell to a reading of 5.6 in June, following a reading of 12.7 posted in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 0.9854, flat from yesterday’s close at 23:00 GMT.

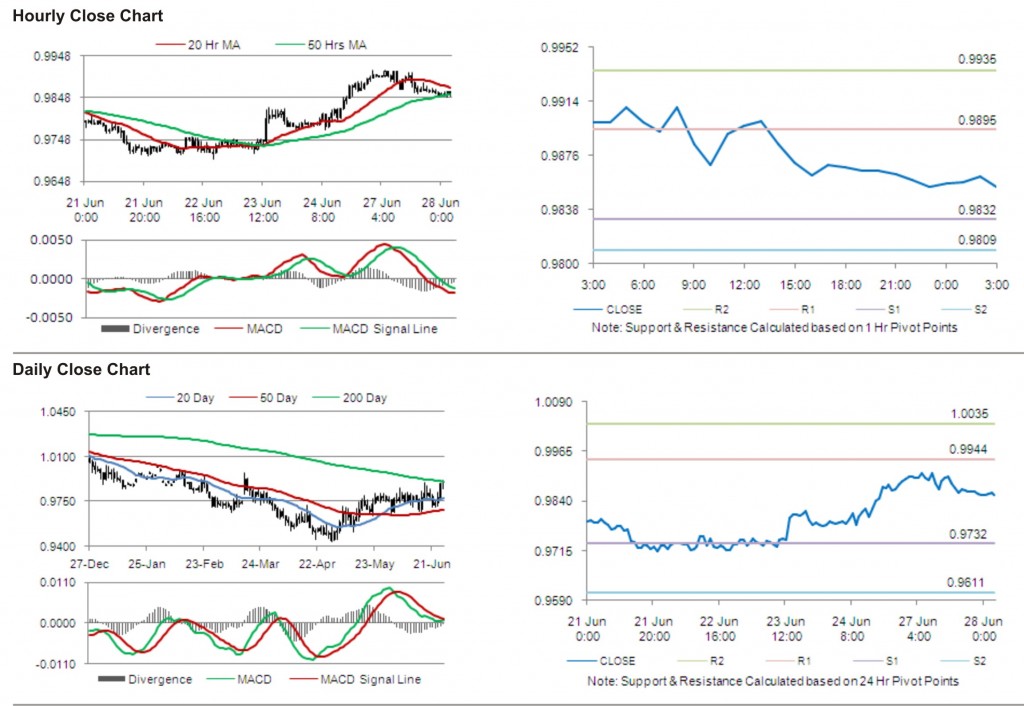

The first area of short term resistance is observed at 0.9895, followed by 0.9935 and 0.9998. The first area of support is at 0.9832, with the subsequent supports at 0.9809 and 0.9746.

The currency pair is showing convergence with its 50 Hr moving average and is trading just below its 20 Hr moving average.