For the 24 hours to 23:00 GMT, USD declined 1.45% against the CAD to close at 0.9677. Rise in Canadian dollar was boosted by domestic inflation data, that further raised investors speculations that the central bank would soon raise interest rates. The currency was also benefited from improved global market sentiment, as commodities, rose after Greece’s parliament approved a five-year austerity plan designed to prevent the country from going bankrupt.

In Canada, the consumer price inflation, on monthly basis, rose by 0.2% in May compared to 0.3% increase in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 0.9680, 0.03% higher from yesterday’s close at 23:00 GMT.

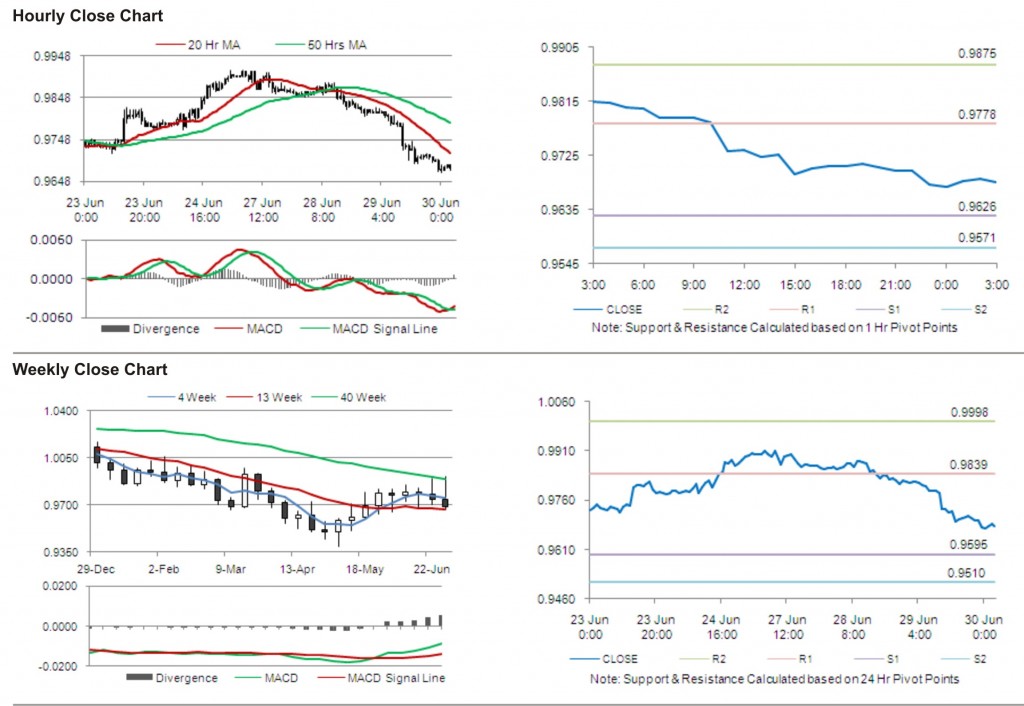

The first area of short term resistance is observed at 0.9778, followed by 0.9875 and 1.0027. The first area of support is at 0.9626, with the subsequent supports at 0.9571 and 0.9419.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.