For the 24 hours to 23:00 GMT, GBP fell 0.25% against the USD and closed at 1.6091.

Bank of England Governor Mervyn King stated that BoE may keep borrowing costs at a record low to aid a recovery that is “unlikely to be smooth.â€

In the UK, in December, the ILO Unemployment Rate (3M) stayed unchanged at 7.9%, while the Claimant Count Rate increased 4.5%. The Average Earnings, excluding Bonus rose 2.3%, while including bonus, rose 1.8%.

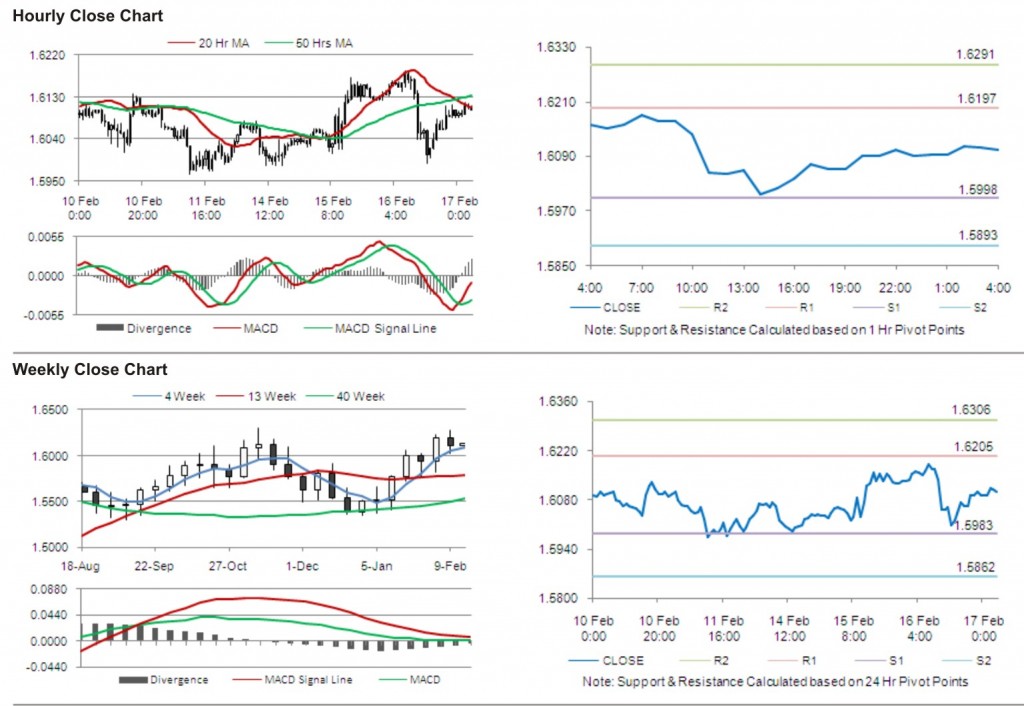

The pair opened the Asian session at 1.6091, and is trading at 1.6103 at 4.00GMT. The pair is trading 0.07% higher from the New York session close.

The pair has its first short term resistance at 1.6197, followed by the next resistance at 1.6291. The first support is at 1.5998, with the subsequent support at 1.5893.

Investors are expected to focus on inflation report of BoE for any additional signals.

Trading trends in the pair today are expected to be determined by release of data on CBI industrial trends survey.

The pair is trading just below its 20 Hr and 50 Hr moving averages.