For the 24 hours to 23:00 GMT, EUR declined 0.80% against the USD and closed at 1.4430, amid disappointing euro zone economic data and lingering sovereign debt concerns.

Moody’s Investors Service, yesterday, downgraded Portugal’s credit rating to Ba2, or junk grade, from Baa1, on concerns that the southern European country would need to follow Greece in seeking a second international bailout.

In the Euro zone, the services Purchasing Manager’ Index (PMI) declined to 53.7 in June compared to 54.2 points in May. On a monthly basis, the retail sales in the Euro-zone declined 1.1% in May, following a revised 0.7% gain recorded in the previous month.

In the Germany economic news, the PMI for services stood at 56.7 in June, lower than the flash estimate reading of 58.3.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4462, 0.22% higher from the levels yesterday at 23:00GMT.

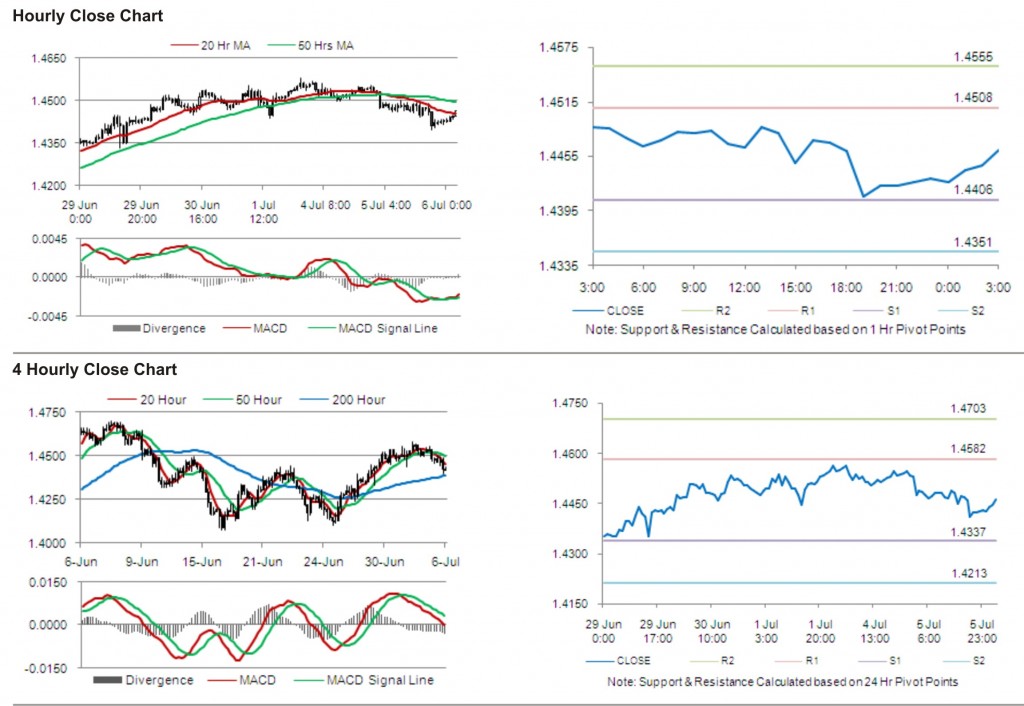

The pair has its first short term resistance at 1.4508, followed by the next resistance at 1.4555. The first support is at 1.4406, with the subsequent support at 1.4351.

Trading trends in the pair today are expected to be determined by data release on gross domestic product in the Euro zone.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.