For the 24 hours to 23:00 GMT, the USD declined 0.08% against the CAD and closed at 1.2959.

On the macro front, Canada’s trade deficit contracted to a 6-month low level of C$1.90 billion in April, amid a surge in exports and decline in imports. The nation had posted a revised deficit of C$3.93 billion in the prior month.

Meanwhile, Canada’s building permits retreated by 4.6% on a monthly basis in April, hitting a 5-month low and thereby signalling weakness in the residential and non-residential sectors. In the previous month, building permits had recorded a revised increase of 1.3%, while market participants anticipated for a drop of 1.0%. Further, the nation’s seasonally adjusted Ivey PMI registered a drop to 62.5 in May. In the prior month, the PMI had recorded a reading of 71.5.

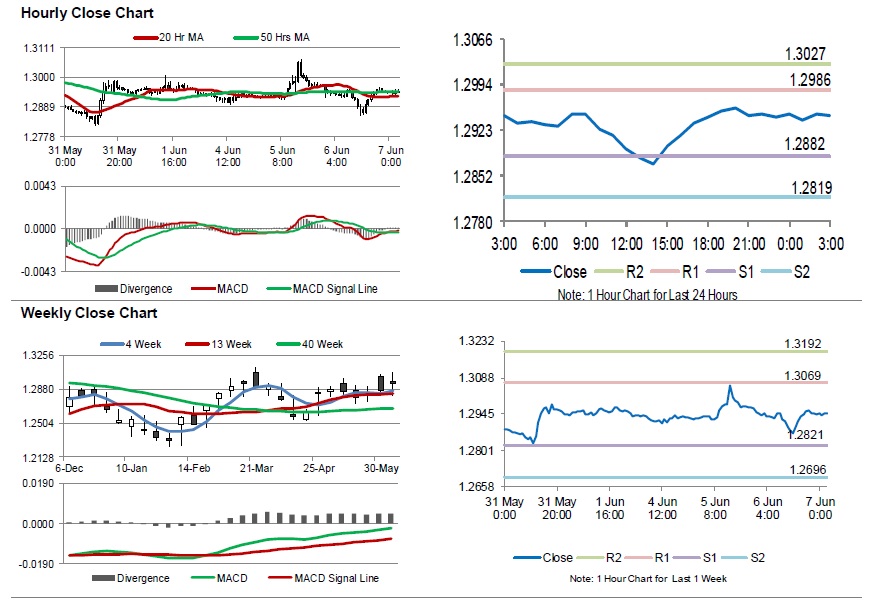

In the Asian session, at GMT0300, the pair is trading at 1.2946, with the USD trading 0.1% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2882, and a fall through could take it to the next support level of 1.2819. The pair is expected to find its first resistance at 1.2986, and a rise through could take it to the next resistance level of 1.3027.

With no macroeconomic releases in Canada today, investor sentiment will be determined by global macroeconomic factors.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.