For the 24 hours to 23:00 GMT, the EUR declined 0.29% against the USD and closed at 1.1583.

On the macro front, the Euro-zone’s producer price index (PPI) advanced to 4.0% on an annual basis in July, boosted by higher energy prices and beating market expectations for a rise of 3.9%. In the previous month, the PPI had risen 3.6%.

In the US, data showed that the final Markit manufacturing purchasing managers’ index (PMI) dropped to 54.7 in August, marking its weakest reading since November 2017 and less than market expectations for a fall to a level of 54.5. The Markit manufacturing PMI had recorded a reading of 55.3 in the previous month. The preliminary figures had indicated a fall to a level of 54.5. Meanwhile, the nation’s construction spending rose 0.1% on a monthly basis in July, less than market expectations for a rise of 0.5%. In the prior month, construction spending had dropped by a revised 0.8%. On the contrary, the ISM manufacturing activity index unexpectedly advanced to 61.3 in August, helped by a rise in new orders and compared to a level of 58.1 in the prior month. Market participants were expecting the ISM manufacturing activity index to fall to a level of 57.6.

In the Asian session, at GMT0300, the pair is trading at 1.1603, with the EUR trading 0.17% higher against the USD from yesterday’s close.

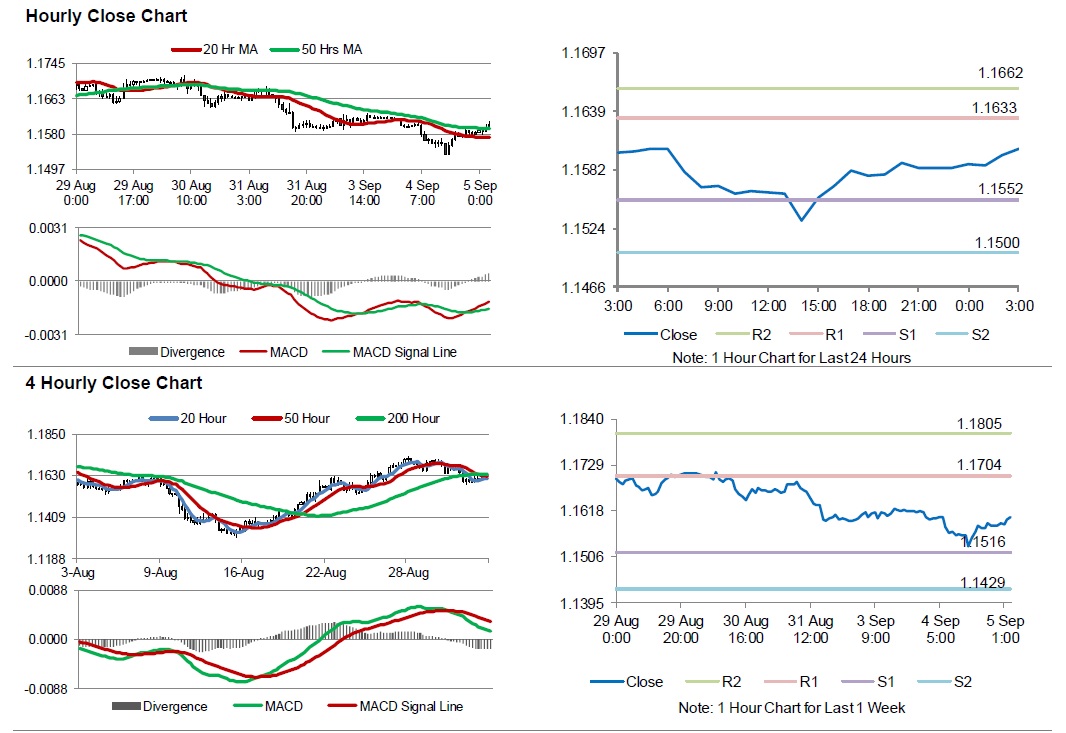

The pair is expected to find support at 1.1552, and a fall through could take it to the next support level of 1.1500. The pair is expected to find its first resistance at 1.1633, and a rise through could take it to the next resistance level of 1.1662.

Going ahead, investors would keep an eye on the Euro-zone’s retail sales data for July, along with the final services PMI for August, set to release across the euro bloc in a few hours. Moreover, the US MBA mortgage applications followed by trade balance data for July, set to release later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.