For the 24 hours to 23:00 GMT, the EUR rose 0.40% against the USD and closed at 1.1673.

On the data front, the Euro-zone’s final consumer price index (CPI) climbed 2.0% on a yearly basis in August, in line with market expectations and confirming the preliminary print. In the previous month, the CPI had recorded a rise of 2.1%.

The US dollar fell against its major peers yesterday, amid renewed US-China trade war fears and a rise in the US treasury yields. The US President, Donald Trump stimulated the US-China trade dispute by announcing plans to impose tariffs on an additional $200 billion worth of Chinese goods.

In the US, data revealed that the NY Empire State manufacturing index dropped to a level of 19.0 in September, overshooting market consensus for a fall to a level of 23.0. The index had registered a level of 25.6 in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.1688, with the EUR trading 0.13% higher against the USD from yesterday’s close.

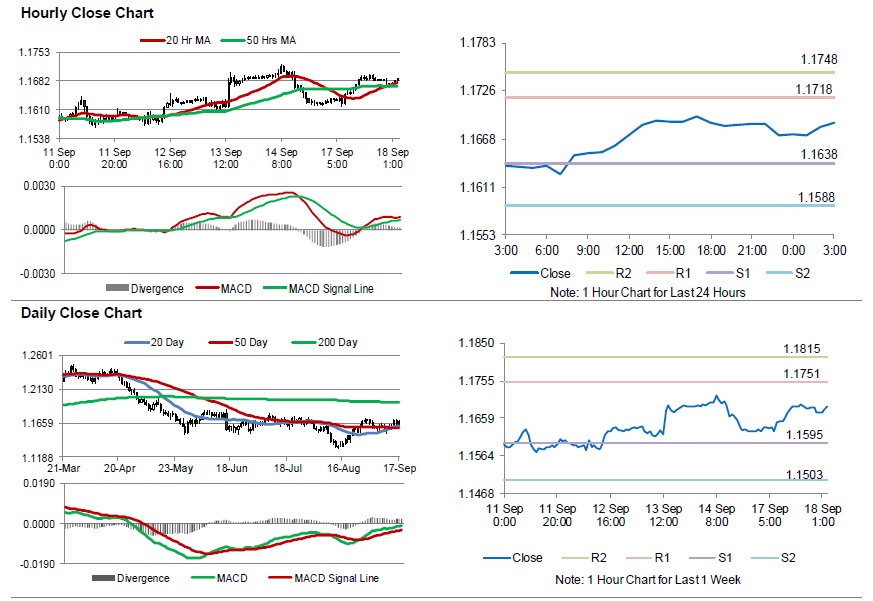

The pair is expected to find support at 1.1638, and a fall through could take it to the next support level of 1.1588. The pair is expected to find its first resistance at 1.1718, and a rise through could take it to the next resistance level of 1.1748.

Amid lack of macroeconomic releases in the Euro-zone today, investors sentiment will be determined by the US NAHB housing market index for September, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.