For the 24 hours to 23:00 GMT, Crude Oil declined 0.92% against the USD and closed at USD60.19 per barrel on Friday, amid growing concerns over rising output and economic slowdown. Additionally, fresh figures from Baker Hughes disclosed that the number of active oil rigs climbed by 12 rigs to 886, in the week ended 09 November, recording its biggest increase since the week ended 25 May 2018.

In the Asian session, at GMT0400, the pair is trading at 60.78, with oil trading 0.98% higher against the USD from yesterday’s close.

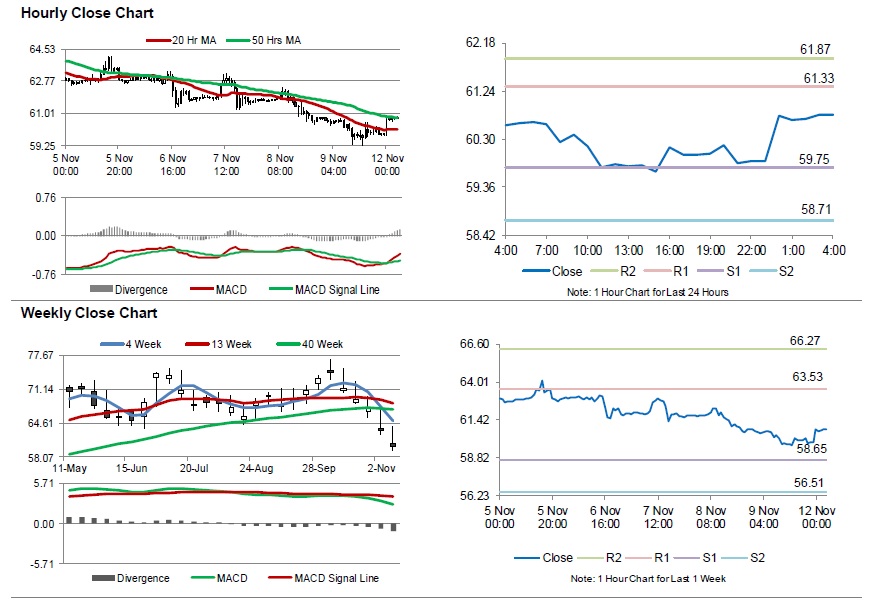

The pair is expected to find support at 59.75, and a fall through could take it to the next support level of 58.71. The pair is expected to find its first resistance at 61.33, and a rise through could take it to the next resistance level of 61.87.

Crude oil is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.