For the 24 hours to 23:00 GMT, the EUR declined 0.06% against the USD and closed at 1.1444, after an unexpected drop in Germany’s industrial output raised fears of a prolonged slowdown in the euro area.

Macroeconomic data indicated that the Euro-zone’s final consumer confidence index dropped to a level of -6.2 in December, in line with market expectations and confirming the preliminary print. In the previous month, the index had recorded a level of -3.9. Moreover, the region’s economic sentiment indicator declined to a 2-year low level of 107.3 in December, overshooting market consensus for a drop to a level of 108.2. In the preceding month, the economic sentiment indicator had recorded a level of 109.5. Additionally, the business climate indicator fell to a level of 0.82 in December, declining to its lowest level since May 2017 and compared to a revised level of 1.04 in the prior month. Market participants had anticipated the business climate indicator to ease to a level of 1.0.

Separately in Germany, the seasonally adjusted industrial production unexpectedly declined 1.9% on a monthly basis in November, driven by a sharp decline in consumer goods and energy output and defying market expectations for a gain of 0.3%. Industrial production had registered a revised drop of 0.8% in the previous month.

In the US, data indicated that the US small business optimism index slid to a level of 104.4 in December, compared to market consensus for a fall to a level of 103.0. The index had recorded a level of 104.8 in the previous month.

On the other hand, the nation’s consumer credit recorded a rise of $22.2 billion, helped by rise in student and auto loans and higher than market expectations for a rise of $17.5 billion. In the prior month, consumer credit had registered a climb of $25.4 billion.

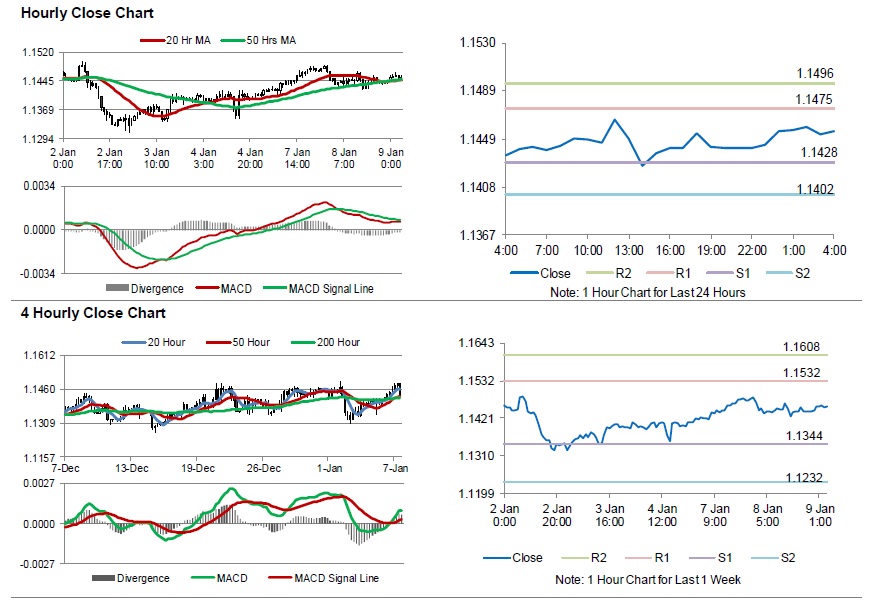

In the Asian session, at GMT0400, the pair is trading at 1.1455, with the EUR trading 0.10% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1428, and a fall through could take it to the next support level of 1.1402. The pair is expected to find its first resistance at 1.1475, and a rise through could take it to the next resistance level of 1.1496.

Moving forward, traders would closely monitor the Euro-zone’s unemployment rate and Germany’s trade balance data, both for November, slated to release in a few hours. Later in the day, the US FOMC meeting minutes along with trade balance data for November, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.