For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1146.

The European Central Bank (ECB) left its benchmark interest rate unchanged at 0.00% and indicated that interest rates would remain at the current low level throughout the first half of 2020. Further, the central bank notified its plan to restart its bond-buying program in order to boost the country’s economic growth. In a statement post-meeting, the ECB President Mario Draghi, highlighted the need for significant stimulus for the euro area economy, to ensure that financial conditions remain very favourable and support the euro area expansion. Further, he stated that growth is set to slow in the second and third quarters, citing ongoing global trade tensions, and hence, a rebound in the second half of the year is less likely.

In economic news, Germany’s Ifo business climate index fell to a level of 95.7 in July, more than market expectations for a decline to a level of 97.2. The index had registered a revised reading of 97.50 in the previous month. Moreover, the nation’s Ifo business expectations index unexpectedly slid to a decade low level of 92.2 in July, compared to a revised level of 94.0. Further, the Ifo current assessment index declined to a level of 99.4 in July, surpassing market consensus for a drop to a level of 100.4. The index had recorded a revised level of 101.1 in the previous month.

In the US, data showed that the advance goods trade deficit narrowed to $74.20 billion in June, following a revised deficit of $75.00 billion in the prior month. Market participants had anticipated the nation to post a deficit of $72.5 billion.

Meanwhile, the US flash durable goods orders rose 2.0% on a monthly basis in June, compared to a revised drop of 2.3% in the previous month. Also, the nation’s seasonally adjusted initial jobless claims unexpectedly fell to a 3-month low level of 206.0K in the week ended 20 July 2019, defying market expectations for a rise to a level of 218.0k. In the prior week, initial jobless claims had recorded a reading of 216.0K.

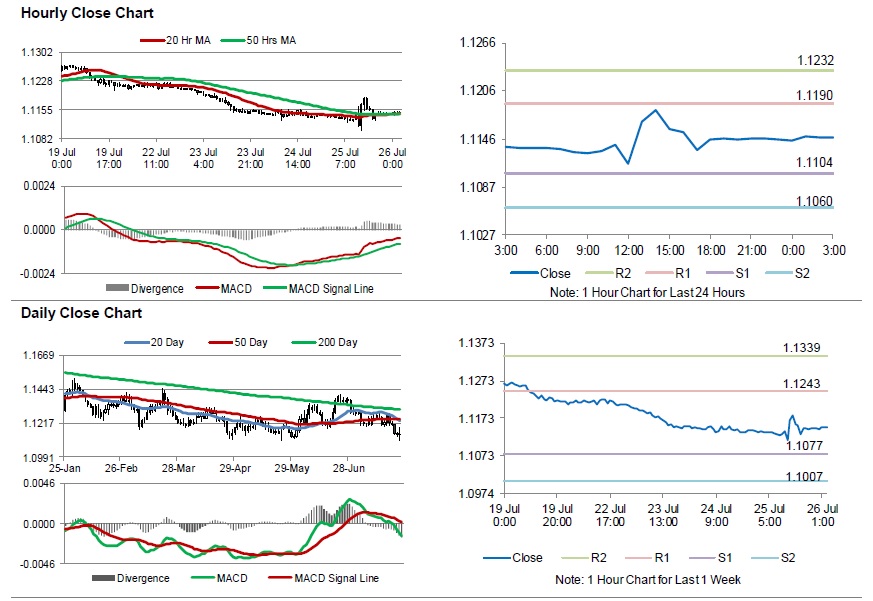

In the Asian session, at GMT0300, the pair is trading at 1.1148, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1104, and a fall through could take it to the next support level of 1.1060. The pair is expected to find its first resistance at 1.1190, and a rise through could take it to the next resistance level of 1.1232.

Amid lack of macroeconomic releases in the Euro-zone today, traders would keep an eye on the US annualised gross domestic product for the second quarter, set to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.