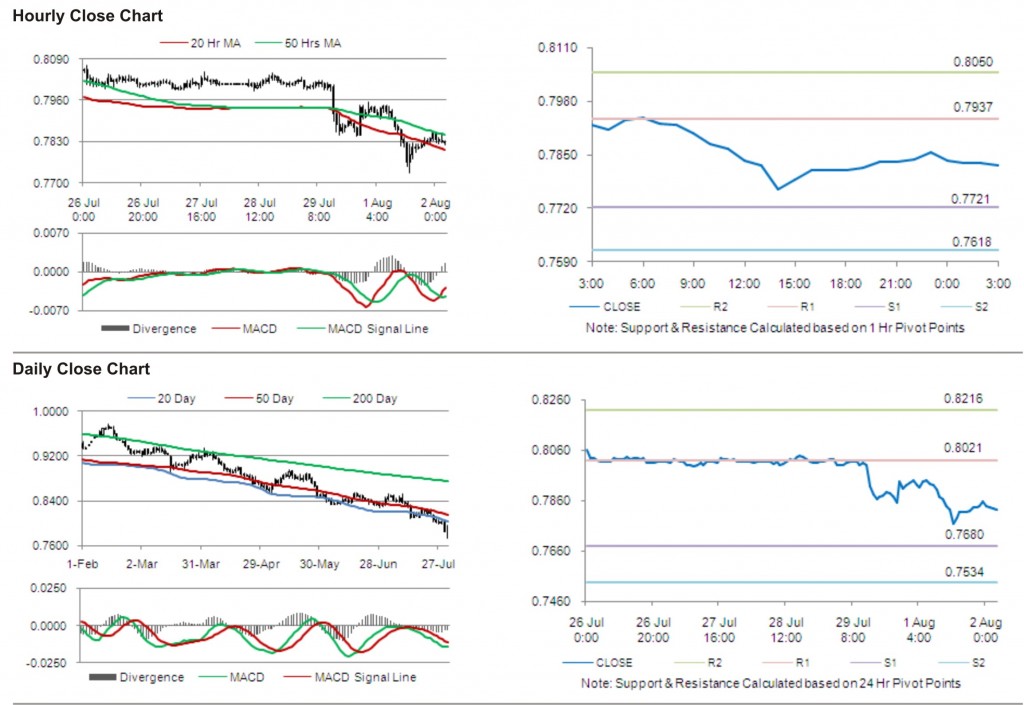

For the 24 hours to 23:00 GMT, USD declined 0.65% against the CHF and closed at 0.7855, on investor concerns that a deal to raise the US borrowing limit would not be enough to avoid a downgrade to the country’s triple-A credit rating.

In the US, the ISM manufacturing index declined to 50.9 in July from 55.3 in the previous month.

In the Asian session, at 3:00GMT, the pair is trading at 0.7825, 0.38% lower from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 0.7937, followed by the next resistance at 0.8050. The first area of support is at 0.7721 level, with the subsequent support at 0.7618.

The pair is expected to trade on the cues from the release of Purchasing Managers’ Index and real retail sales in Switzerland.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.