For the 24 hours to 23:00 GMT, AUD weakened 2.11% against the USD to close at 1.0741, after the Reserve Bank of Australia (RBA) decided to keep the cash rate on hold for at least another month.

Australia’s central bank decided to retain the benchmark interest rate unchanged at 4.75%.

The Reserve Bank of Australia Governor, Glenn Stevens stated that it was prudent to maintain the current monetary policy in view of the uncertainty prevailing in the global financial markets.

In the economic news this morning, the AiG performance of services index rises to 48.8 in July, compared to a reading of 48.5 in the previous month. The trade balance declined to A$2.05 billion in June, from A$2.7 billion in the previous month. The retail sales declined 0.1% (M-o-M) in June, following a 0.6% decline in the previous month.

In the Asian session at 3:00GMT, the pair is trading at 1.0725, 0.15% lower from yesterday’s close at 23:00 GMT.

LME Copper prices declined 2.0% or $199.3/MT to $9,627.5/ MT. Aluminium prices declined 2.5% or $64.8/MT to $2,540.5/ MT.

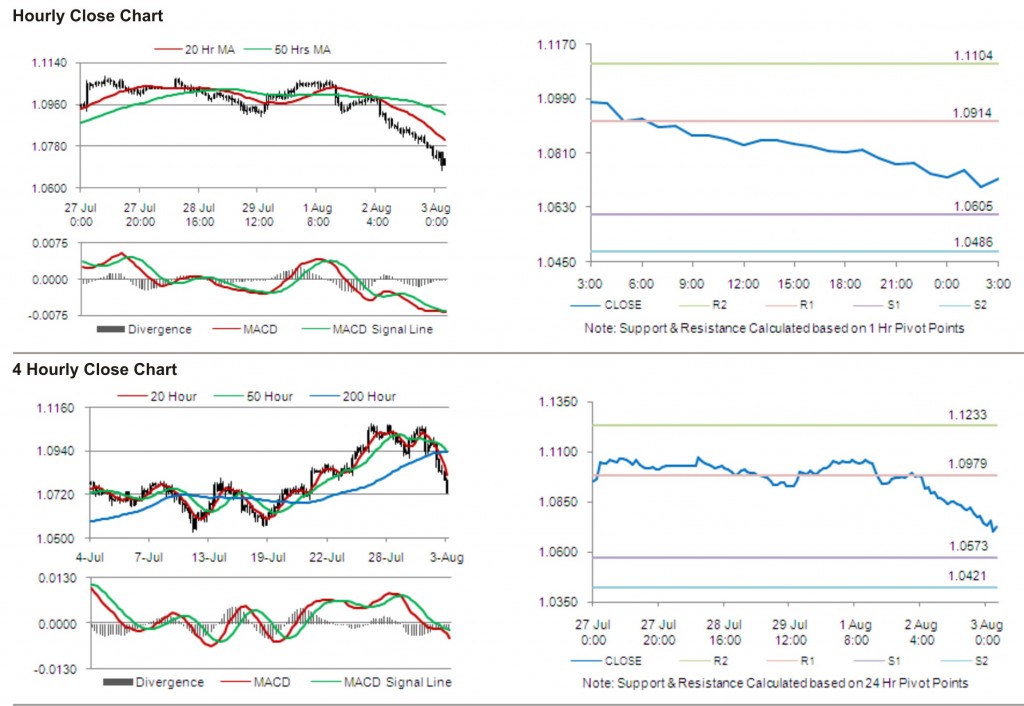

The pair is expected to find first short term resistance at 1.0914, with the next resistance levels at 1.1104 and 1.1413, subsequently. The first support for the pair is seen at 1.0605, followed by next supports at 1.0486 and 1.0177 respectively.

The currency pair is trading well below its 20 Hr and its 50 Hr moving averages.