For the 24 hours to 23:00 GMT, USD rose 0.68% against the CHF and closed at 0.7704, amid SNB interest rate decision.

The Swiss central bank cut interest rates and stated that it would increase the supply of Francs to money markets to curb the “massively overvalued” currency.

In the economic news, the UBS Bank reported that its real estate bubble index in Switzerland rose to a reading of 0.65 in the second quarter of 2011 (2Q FY2011), compared to a reading of 0.63 recorded in 1Q FY2011.

In the Asian session, at 3:00GMT, the pair is trading at 0.7761, 0.74% higher from yesterday’s close at 23:00 GMT.

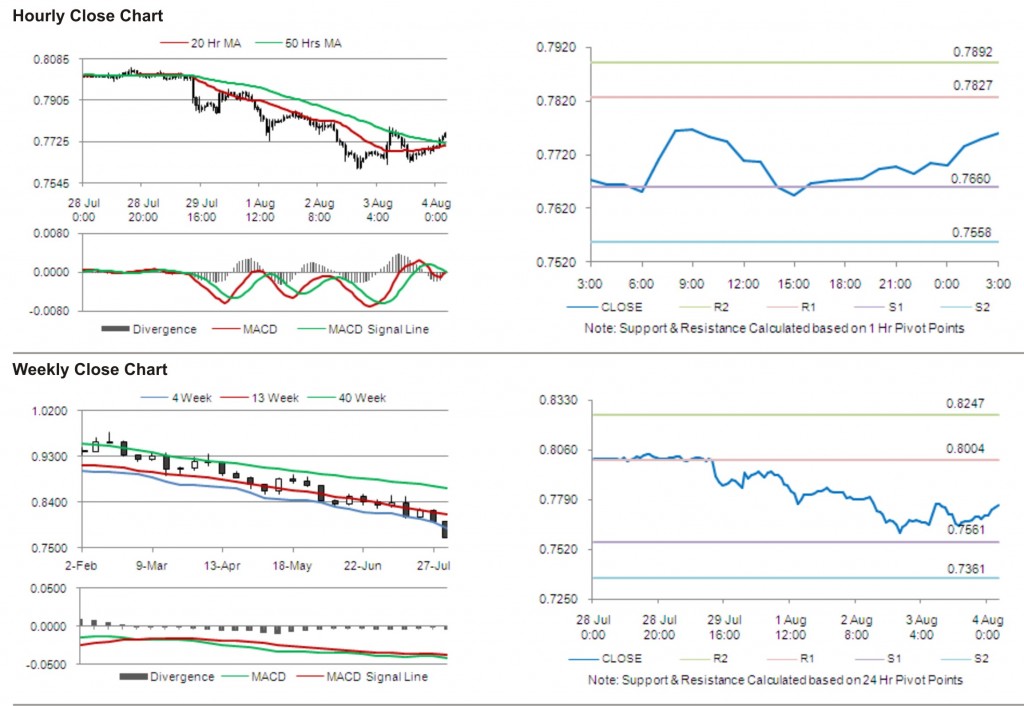

The pair has its first short term resistance at 0.7827, followed by the next resistance at 0.7892. The first area of support is at 0.7660 level, with the subsequent support at 0.7558.

The currency pair is trading above its 20 Hr and its 50 Hr moving averages.