For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1152.

On the data front, Euro-zone’s seasonally adjusted preliminary gross domestic product (GDP) rose 0.2% on a quarterly basis in 3Q 2019, surpassing market expectations for a rise of 0.1%. In the previous quarter, GDP had registered a similar rise. Moreover, the region’s preliminary consumer price index (CPI) advanced 0.7% on an annual basis in October, at par with market expectations. The CPI had recorded a rise of 0.8% in the prior month. Meanwhile, the nation’s unemployment rate remained unchanged at 7.5% in September, marking its lowest level since July 2008.

Separately, in Germany, retail sales rose 3.4% on a yearly basis in September, less than market expectations for a rise of 3.5%. In the preceding month, retail sales had recorded a revised rise of 3.1%.

In the US, data showed that the Chicago Fed Purchasing Managers’ Index unexpectedly declined to a 4-year low level of 43.2 in October, defying market expectations for a rise to a level of 48.0. In the previous month, the index had recorded a level of 47.1. Further, the seasonally adjusted initial jobless claims climbed to a level of 218.0K on a weekly basis in the week ended 25 October 2019, more than market anticipations for a rise to a level of 215.0K. In the previous week, initial jobless claims had recorded a revised level of 213.0K. Meanwhile, the nation’s personal spending rose 0.2% on a monthly basis in September. In the prior month, personal spending had registered a revised similar rise. Moreover, personal income rose 0.3% on a monthly basis in September, at par with market expectations. In the prior month, personal income had registered a revised advance of 0.5%.

In the Asian session, at GMT0400, the pair is trading at 1.1164, with the EUR trading 0.11% higher against the USD from yesterday’s close.

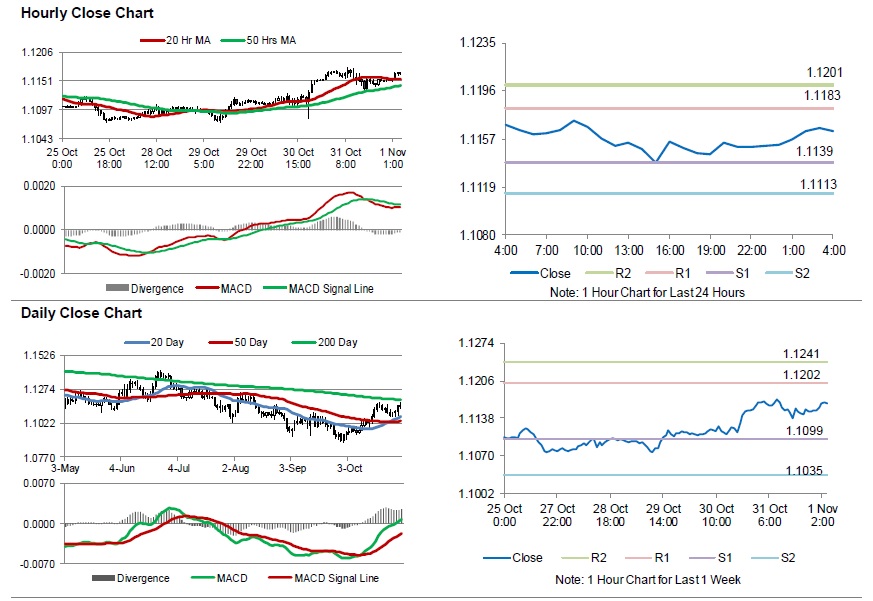

The pair is expected to find support at 1.1139, and a fall through could take it to the next support level of 1.1113. The pair is expected to find its first resistance at 1.1183, and a rise through could take it to the next resistance level of 1.1201.

Amid lack of macroeconomic releases in the Euro-zone today, traders would focus on the US nonfarm payrolls, average weekly earnings, unemployment rate, the Markit manufacturing PMI and the ISM manufacturing PMI, all for October followed by construction spending data for September, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.