For the 24 hours to 23:00 GMT, GBP fell 1.11% against the USD and closed at 1.6122, after the Bank of England quarterly inflation report indicated that the outlook for growth has weakened.

The BoE Governor, Mervyn King, stated that the UK economy would face major downward risks, especially if the Euro-zone debt crisis continues.

In the economic news, the Bank of England (BoE) in its quarterly inflation report indicated that the UK inflation would drop through 2012 and into 2013. Meanwhile, the central bank lowered its full year growth forecast for 2011 to 1.4%.

The pair opened the Asian session at 1.6122, and is trading at 1.6171 at 3.00GMT. The pair is trading 0.30% higher from yesterday’s close at 23:00 GMT.

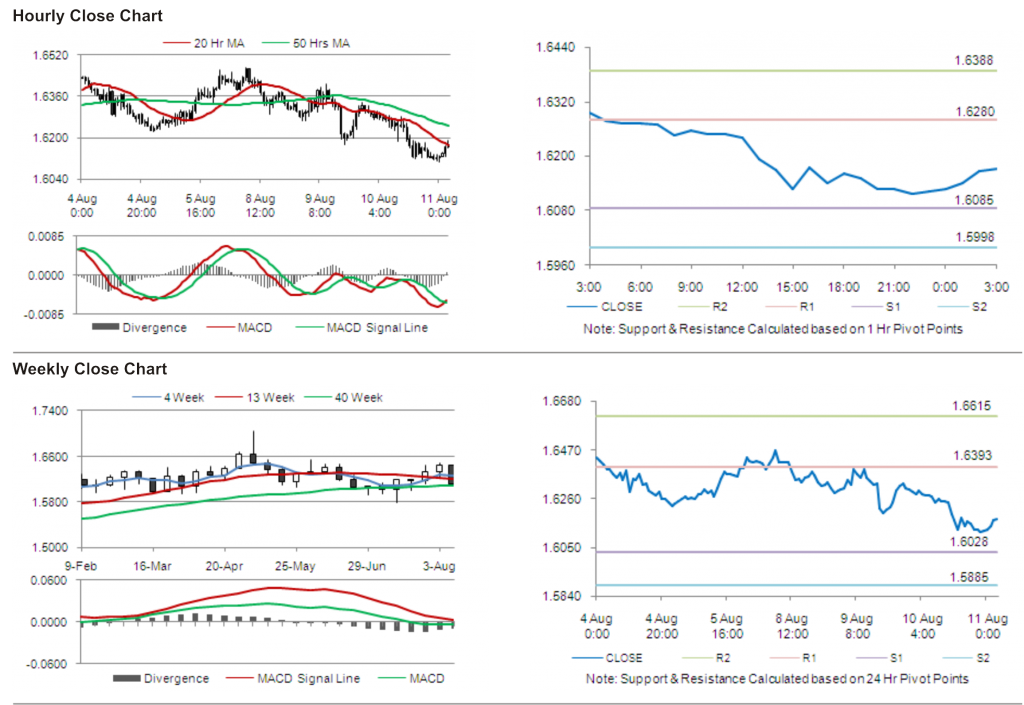

The pair has its first short term resistance at 1.6280, followed by the next resistance at 1.6388. The first support is at 1.6085, with the subsequent support at 1.5998.

Trading trends in the pair today are expected to be determined by release of leading indicator index in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.