For the 24 hours to 23:00 GMT, AUD strengthened 0.98% against the USD to close at 1.0480, as rise in the US stock markets overshadowed the weak US economic data, raising appeal for high yielding assets.

In the Asian session at 3:00GMT, the pair is trading at 1.0491, 0.10% higher from yesterday’s close at 23:00 GMT, after the release of RBA minutes.

The Reserve Bank of Australia (RBA) stated that the ongoing instability in global financial markets was a threat to economic growth, as they voted for the central bank to keep interest rates unchanged at its last policy meeting in August.

LME Copper prices declined 0.3% or $27.3/MT to $8,823.5/ MT. Aluminium prices declined 1.4% or $33.3/MT to $2,345.3/ MT.

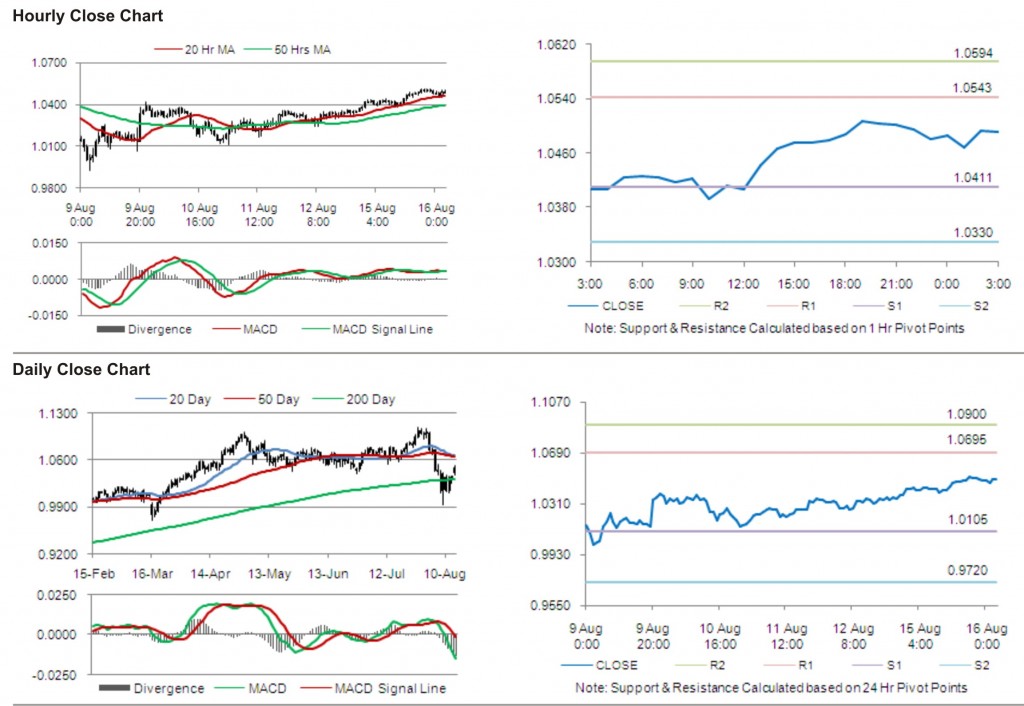

The pair is expected to find first short term resistance at 1.0543, with the next resistance levels at 1.0594 and 1.0726, subsequently. The first support for the pair is seen at 1.0411, followed by next supports at 1.0330 and 1.0198 respectively.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.