For the 24 hours to 23:00 GMT, EUR rose 0.29% against the USD and closed at 1.4435, amid speculations that the European Central Bank was purchasing Spanish and Italian sovereign bonds.

The Federal Reserve Bank of Dallas President, Richard Fisher stated that the Central Bank’s attempts to stimulate the economy and avert a new recession have failed. Further, he added that Fed’s plan to maintain interest rates lower for a longer period of time may not help stimulate the economy.

Meanwhile, in the economic news, on a seasonally adjusted basis, the current account deficit in the Euro zone widened to €7.4 billion in June, compared to a current account deficit of €5.6 billion recorded in May. The consumer price inflation declined to 2.5% (Y-o-Y) in July, compared to a rate of 2.7% recorded in June.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4398, 0.26% lower from the levels yesterday at 23:00GMT.

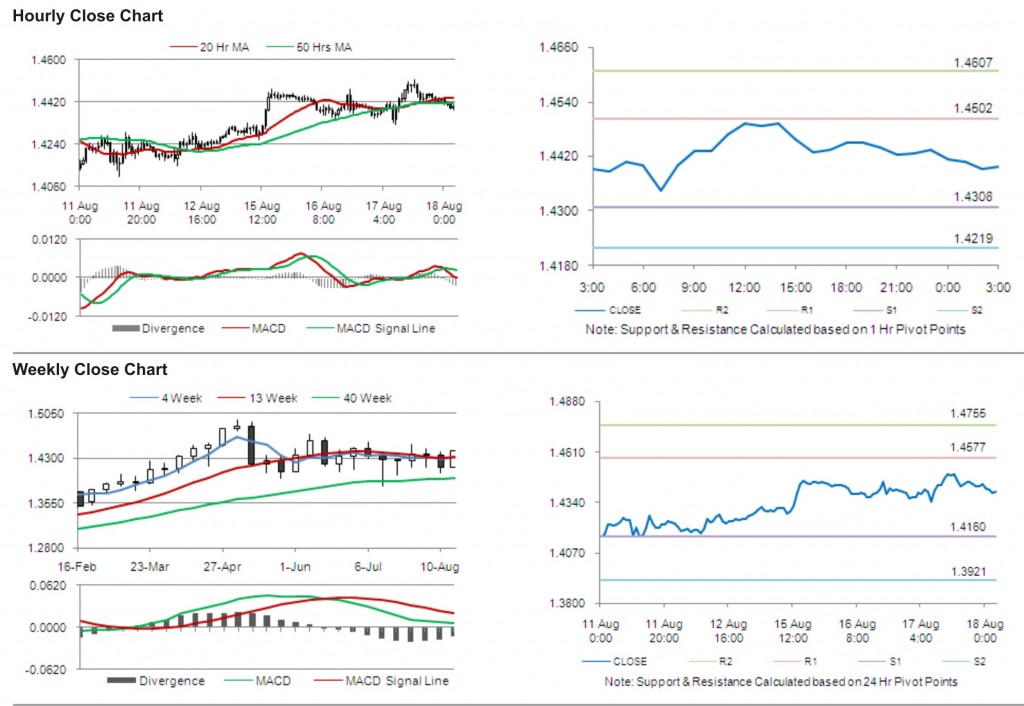

The pair has its first short term resistance at 1.4502, followed by the next resistance at 1.4607. The first support is at 1.4308, with the subsequent support at 1.4219.

Trading trends in the pair today are expected to be determined by data release on construction output in the Euro zone.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.