For the 24 hours to 23:00 GMT, GBP rose 0.61% against the USD and closed at 1.6543, after the Bank of England (BoE) minutes from a policy meeting showed unanimous support for keeping interest rate at a record low.

The Bank of England minutes indicated that policy makers unanimously decided to leave the interest rate unchanged at 0.5%. Meanwhile eight member of the monetary policy committee voted to maintain the stock of asset purchases at £200.0 billion, while Adam Posen voted £50.0 billion increase in the asset purchase program.

In economic news, the unemployment rate in the UK rose to 7.9% in the three months to June, compared to a rate of 7.7% recorded in the three months to May. Meanwhile, the number of people claiming jobseeker’s allowance increased 37,100 to 1.56 million in July, the biggest gain since May 2009.

The pair opened the Asian session at 1.6543, and is trading at 1.6522 at 3.00GMT. The pair is trading 0.13% lower from yesterday’s close at 23:00 GMT.

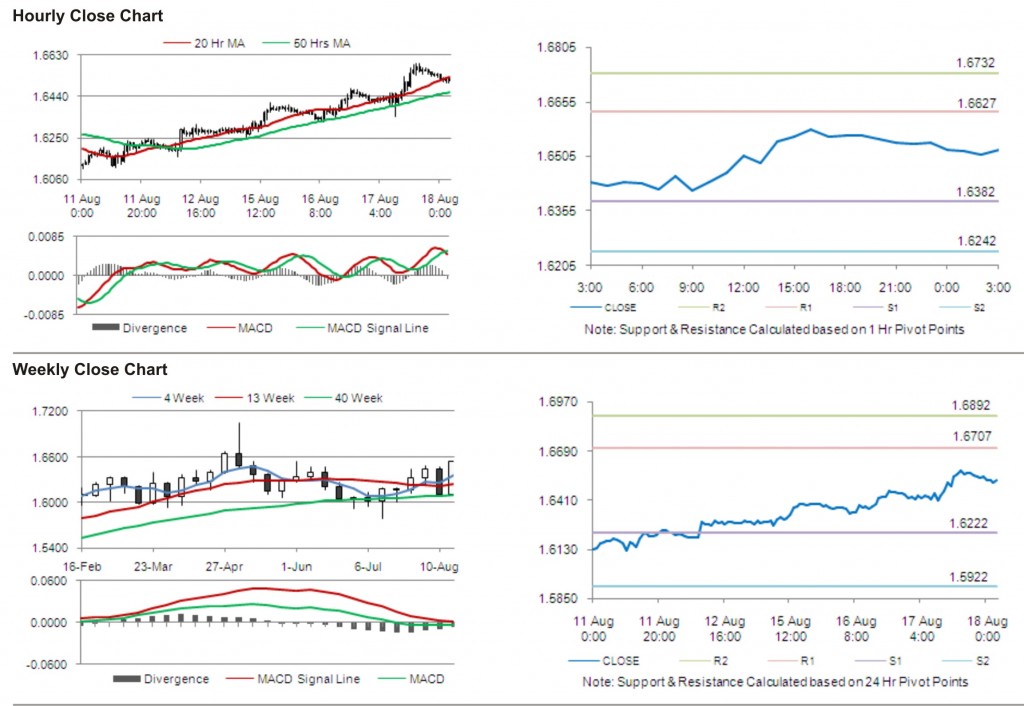

The pair has its first short term resistance at 1.6627, followed by the next resistance at 1.6732. The first support is at 1.6382, with the subsequent support at 1.6242.

Trading trends in the pair today are expected to be determined by release of retail sales data in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.