For the 24 hours to 23:00 GMT, EUR declined 0.86% against the USD and closed at 1.4311, amid rising fears that the European banking system is on the verge of a meltdown. With the region’s sovereign debt crisis unresolved despite plans for a euro zone economic government, investors remained anxious over the long-term prospects for the common currency.

Global investment bank Morgan Stanley, yesterday, cut the growth forecast for the world economy to 3.9% from 4.2% in 2011, citing inadequate policy response, disappointing data and prospects of further fiscal tightening.

Standard & Poor’s, yesterday, confirmed France’s AAA rating and stable outlook, dismissing investor fears that the top-notch rating of the Euro zone’s second-largest economy may be at risk.

In economic news, the construction output in the Euro zone declined 1.8% (M-o-M) in June, following a 0.1% growth in the previous month.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4333, 0.15% higher from the levels yesterday at 23:00GMT.

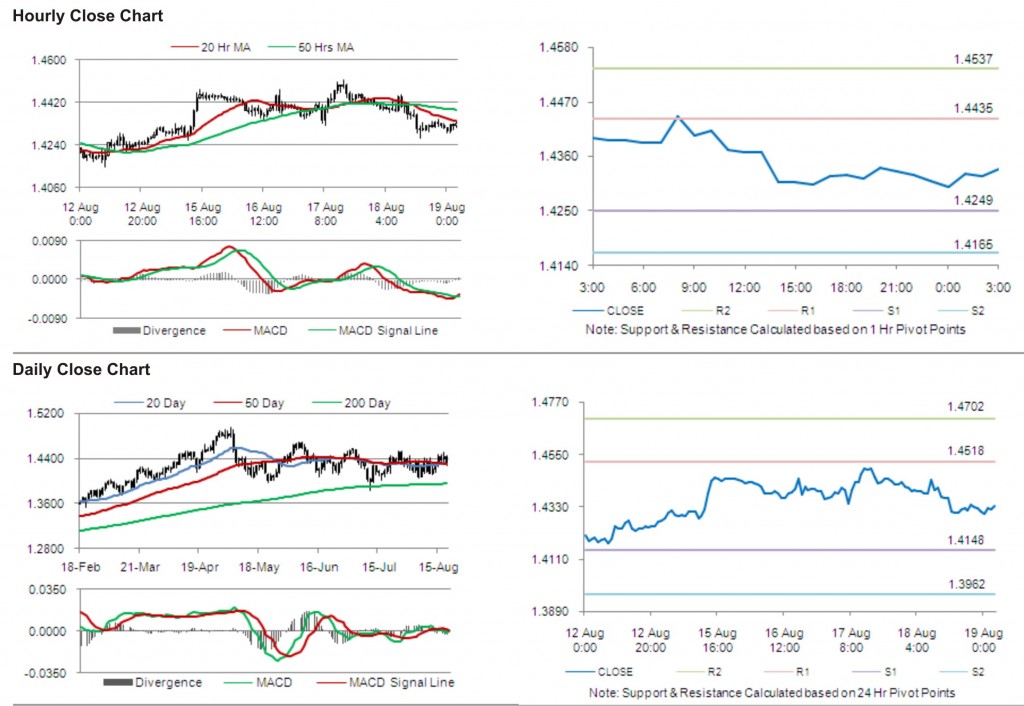

The pair has its first short term resistance at 1.4435, followed by the next resistance at 1.4537. The first support is at 1.4249, with the subsequent support at 1.4165.

Trading trends in the pair today are expected to be determined by release of Producer Price Index in Germany.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.