For the 24 hours to 23:00 GMT, GBP fell 0.53% against the USD and closed at 1.6281.

The Bank of England Policy maker, Martin Weale stated that he abandoned his call for an interest-rate increase this month due to the risk of contagion from the US and Europe.

The Confederation of British Industry (CBI) indicated that the balance of retailers reporting a fall in sales volume retreated to -14.0% in August, from a balance of -5.0% in July.

The pair opened the Asian session at 1.6281, and is trading at 1.6300 at 3.00GMT. GBP is trading 0.12% higher versus USD from yesterday’s close at 23:00 GMT.

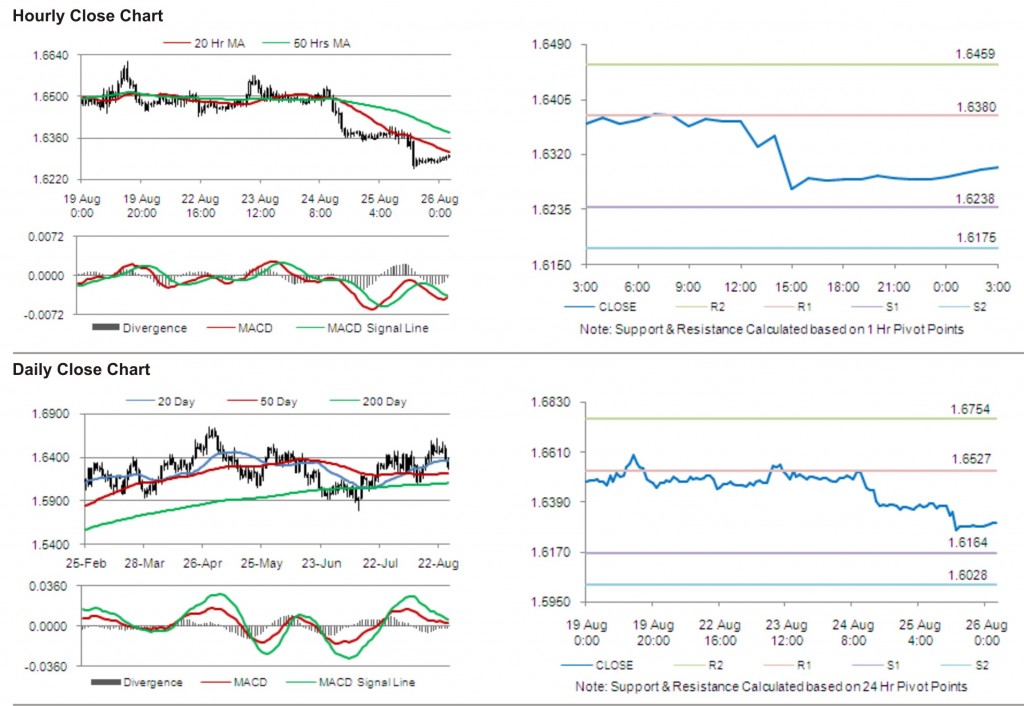

The pair has its first short term resistance at 1.6380, followed by the next resistance at 1.6459. The first support is at 1.6238, with the subsequent support at 1.6175.

With a series of UK economic releases today, including Gross Domestic Product (GDP) and total business investment, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.