For the 24 hours to 23:00 GMT, EUR rose 0.85% against the USD and closed at 1.4494 on Friday.

The greenback came under pressure as investors refocused on the Federal Reserve’s accommodative policy, dampening a burst of dollar-buying after Fed Chairman, Ben Bernanke seemingly ruled out another round of stimulus.

While the Federal Reserve Chairman, Ben Bernanke on Friday gave no details of further action to boost the US recovery, he stated that the central bank would extend its September policy meeting to two days to consider its options.

In the economic news, the money supply in the Euro zone, on quarterly basis, rose 2.1% for the period from May 2011 to July 2011, compared to 2.0% in the period from April 2011 to June 2011.

In the Asian session, at 3:00GMT, the EUR is trading at 1.4489, flat against USD, from the levels on Friday at 23:00GMT.

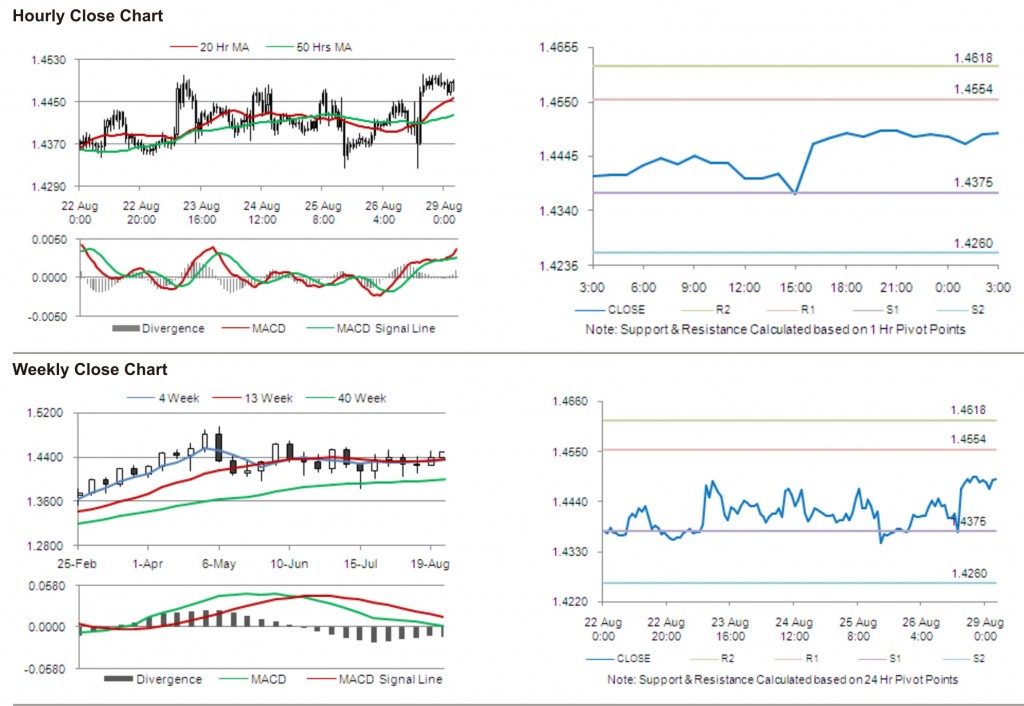

The pair has its first short term resistance at 1.4554, followed by the next resistance at 1.4618. The first support is at 1.4375, with the subsequent support at 1.4260.

Trading trends in the pair today are expected to be determined by release of Consumer Price Index in Germany.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.