Gold prices traded higher by 3.76% against the USD, on Friday, in the 24 hour period ending 23:00GMT, at 1,828.35 per ounce, after Federal Reserve Chairman Ben S. Bernanke offered no plan to provide further stimulus for the economy, while offering a more optimistic view of the US economy.

Ben Bernanke stated that the central bank is ready to provide more support to the US economy and the Fed would extend its mid-September meeting to two days to discuss options possible policy options. While the chairman gave no indications of more quantitative easing, many investors took the September meeting extension as a sign that help was on its way.

In the Asian session at 3:00GMT, gold is trading at USD 1,820.37 per ounce, 0.44% lower from 23:00GMT.

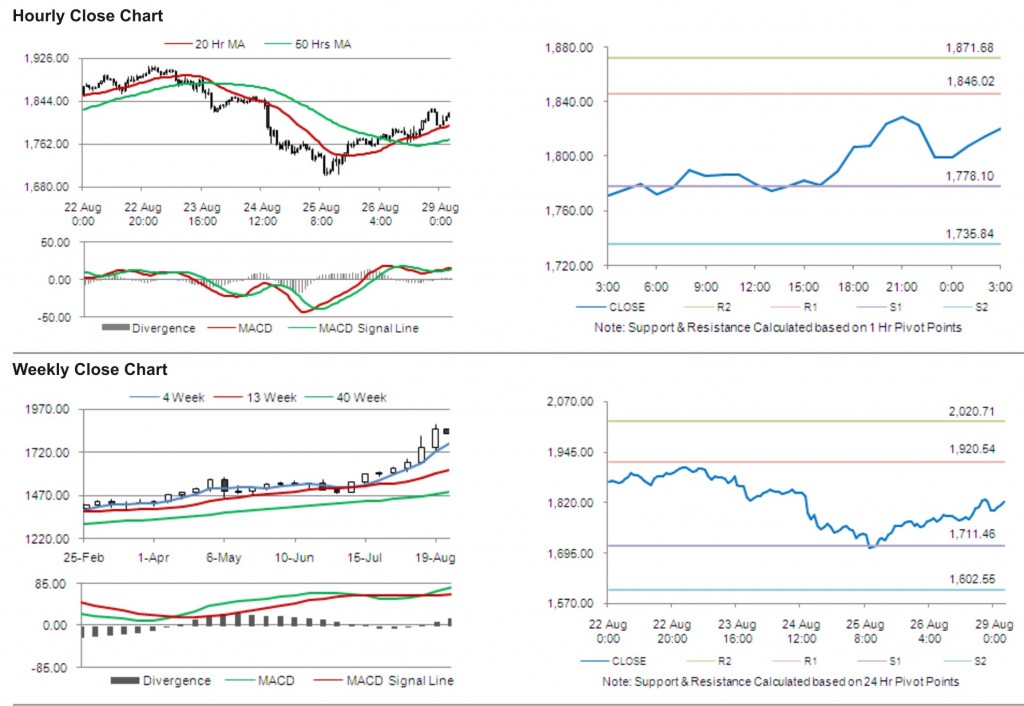

The pair is expected to find its first short term resistance at 1,846.02, with the next resistance at 1,871.68. The pair is expected to find support at 1,778.10 and subsequently at 1,735.84.

The yellow metal is trading above its 20 Hr and its 50 Hr moving averages.