For the 24 hours to 23:00 GMT, USD rose 0.92% against the CHF and closed at 0.8160.

The Swiss Franc weakened yesterday as risk appetite increased after the US Federal Reserve Chairman, Ben Bernanke confirmed on Friday, that he would use appropriate tools to ensure a stronger economic recovery.

Addressing a select group of central bankers and top economists at the Fed’s annual retreat on Friday, Bernanke made no hints that the US economy needs a third round of quantitative easing. However, he warned that Fed policy should not be viewed as a cure-all for the ailing economy, but assured that the central bank stands ready to help if the economy deteriorates. In the Asian session, at 3:00GMT, the USD is trading at 0.8174, 0.17% higher versus Swiss Franc, from yesterday’s close at 23:00 GMT.

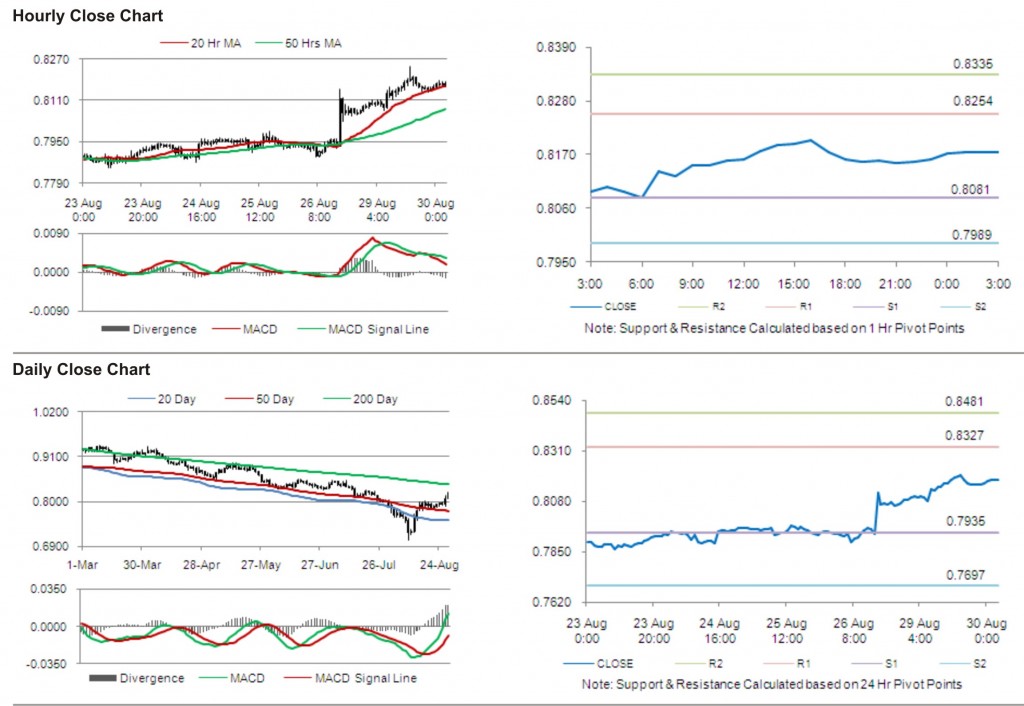

The pair has its first short term resistance at 0.8254, followed by the next resistance at 0.8335. The first area of support is at 0.8081 level, with the subsequent support at 0.7989.

Trading trends in the pair today are expected to be determined by release of UBS consumption indicator in Switzerland.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.