For the 24 hours to 23:00 GMT, AUD weakened 0.05% against the USD, on Friday, to close at 1.0700.

The US Labour Department on Friday reported that employers added no net workers in August and the unemployment rate was unchanged, a sign that many were nervous the world’s largest economy could be at risk of slipping into another recession.

This morning, in Australia, the TD-MI monthly inflation gauge declined 0.1% (M-o-M) in August, compared to a 0.3% (M-o-M) rise in July. Also, the latest Australian Industry Group (AIG)/Commonwealth Bank Performance of Services Index, or PSI, edged up by 3.3 points to 52.1 in August.

In the Asian session at 3:00GMT, the Australian Dollar is trading at 1.0596, 0.97% lower from Friday’s close at 23:00 GMT, as investors feared to trade in riskier currencies, following weak US jobs data.

LME Copper prices declined 0.6% or $50.5/MT to $9050.3/ MT. Aluminium prices declined 0.1% or $1.5/MT to $2399.5/ MT.

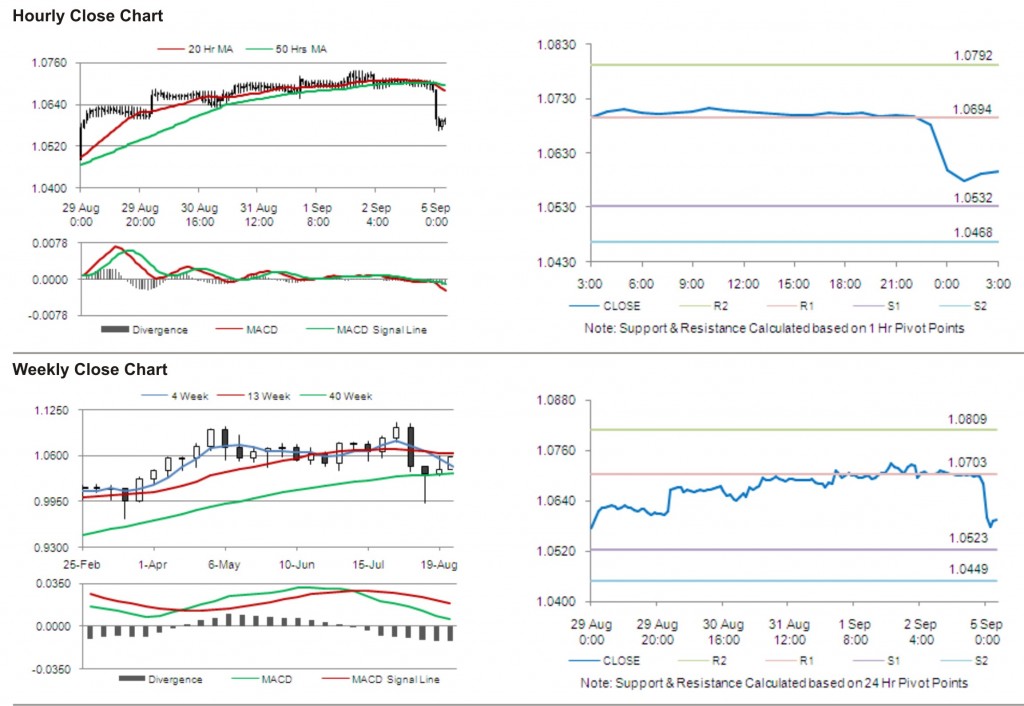

The pair is expected to find first short term resistance at 1.0694, with the next resistance levels at 1.0792 and 1.0954, subsequently. The first support for the pair is seen at 1.0532, followed by next supports at 1.0468 and 1.0306 respectively.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.