For the 24 hours to 23:00 GMT, GBP fell 0.42% against the USD and closed at 1.6101, after economic data showed a sharp slowdown in the UK services sector, fuelling speculation the Bank of England (BOE) may resort to another round of asset purchasing to boost the economy.

In economic news, in the UK, the Purchasing Managers Index (PMI) for services dropped to 51.1 in August, compared to 55.4 in July.

This morning, the British Retail Consortium (BRC) indicated that UK’s like-for-like retail sales retreated 0.6% (Y-o-Y) in August, from a 0.6% (Y-o-Y) rise in July.

The pair opened the Asian session at 1.6101, and is trading at 1.6092 at 3.00GMT. GBP is trading 0.06% lower versus USD from yesterday’s close at 23:00 GMT.

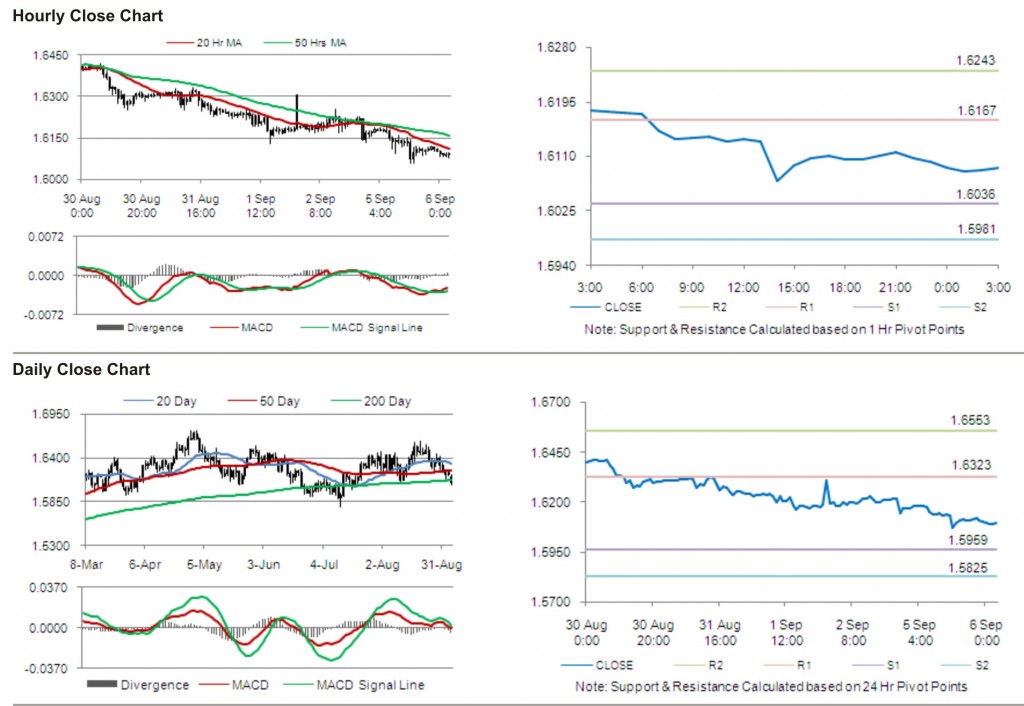

The pair has its first short term resistance at 1.6167, followed by the next resistance at 1.6243. The first support is at 1.6036, with the subsequent support at 1.5981.

The pair is expected to trade on the cues from the release of BRC shop price index in the UK.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.