For the 24 hours to 23:00 GMT, EUR rose 0.55% against the USD and closed at 1.4081, after the German court supported the country’s involvement with euro zone bailouts.

Investor sentiment was further lifted after the Italian senate approved an austerity plan to reduce the country’s deficit by more than €54.0 billion over three years.

On the economic front, Germany’s industrial production climbed 4.0% (M-o-M) in July, from a 1.0% fall in June. Moreover, on a working-day adjusted basis, industrial output rose 10.1% (Y-o-Y) in July, from a 6.6% (Y-o-Y) growth in June.

In the Asian session, at 3:00GMT, the EUR is trading at 1.4061, 0.14% lower against USD, from the levels yesterday at 23:00GMT, on speculation that the European Central Bank President Jean-Claude Trichet could resist calls to reduce the benchmark interest rate later today and may decide to increase the supply of cash to euro-area banks.

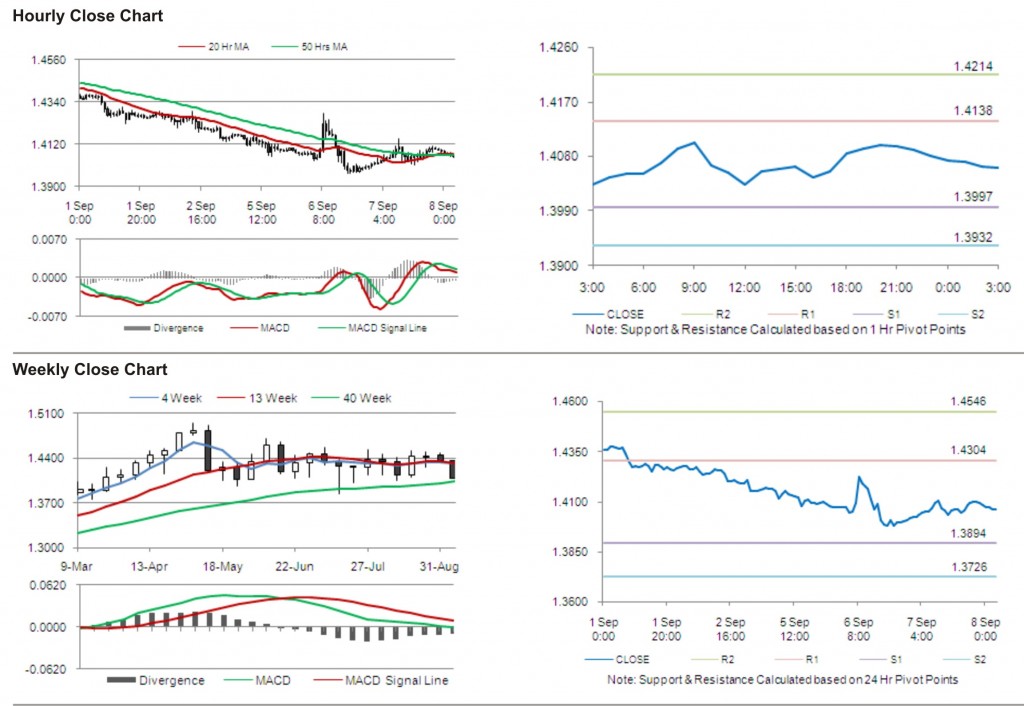

The pair has its first short term resistance at 1.4138, followed by the next resistance at 1.4214. The first support is at 1.3997, with the subsequent support at 1.3932.

European Central Bank President Trichet’s speech is likely to receive increased market attention, along with other economic data due to be released later today.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.