For the 24 hours to 23:00 GMT, GBP rose 0.13% against the USD and closed at 1.5972.

In the UK, Halifax indicated that, the House Price Index edged down 1.2% (M-o-M) in August, compared to a 0.2% rise in July. Also, on a seasonally adjusted basis, industrial production declined by 0.2% (M-o-M) in July, while manufacturing output climbed 0.1% (M-o-M) in July. Separately, the National Institute of Economic and Social Research (NIESR) monthly survey of GDP showed the UK’s output grew by 0.2% in the three month to August, compared to 0.6% growth in the three months to July.

In the US, Mortgage Bankers Association (MBA), reported that on a seasonally adjusted basis, mortgage application volume, edged down 4.9% for the week ended 2 September 2011, from the previous week. Moreover, the refinancing demand for the week retreated 6.3% from the previous week.

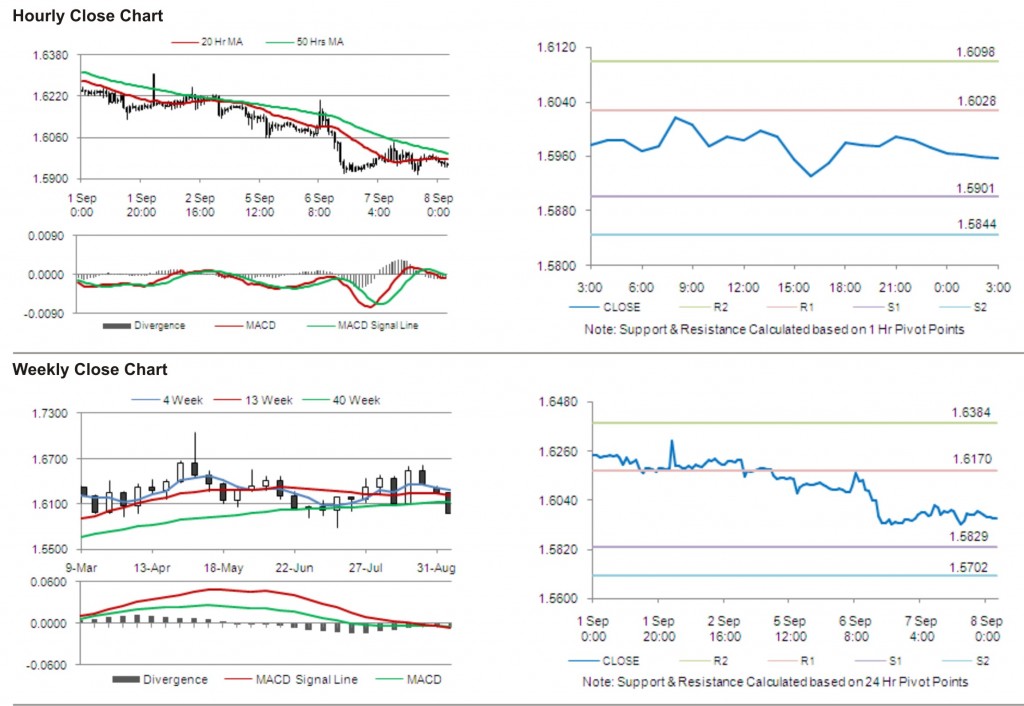

The pair opened the Asian session at 1.5972, and is trading at 1.5957 at 3.00GMT. GBP is trading 0.09% lower versus USD from yesterday’s close at 23:00 GMT.

The pair has its first short term resistance at 1.6028, followed by the next resistance at 1.6098. The first support is at 1.5901, with the subsequent support at 1.5844.

Investors are eying Bank of England (BoE) interest rate decision to be released later today.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.