For the 24 hours to 23:00 GMT, the AUD declined 0.69% against the USD and closed at 0.7512.

LME Copper prices declined 0.1% or $8.5/MT to $6530.5/MT. Aluminium prices declined 1.7% or $34.5/MT to $1994.0/MT.

In the Asian session, at GMT0400, the pair is trading at 0.7515, with the AUD trading marginally higher against the USD from yesterday’s close.

On the macro front, Australia’s seasonally adjusted home loan approvals eased less-than-expected by 0.6% MoM in October, compared to market consensus for a drop of 2.0%. Home loan approvals had registered a fall of 2.3% in the prior month.

Elsewhere in China, Australia’s largest trading partner, trade surplus surprisingly widened to CNY263.6 billion in November, defying market expectations for it to narrow to CNY240.8 billion. In the previous month, the nation’s trade balance had recorded a level of CNY254.5 billion.

Additionally, the nation’s exports jumped more-than-anticipated by 10.3% YoY in November, compared to a gain of 6.1% in the preceding month. Further, annual imports climbed more-than-anticipated by 15.6% on an annual basis in November, after recording a rise of 15.9% in the previous month.

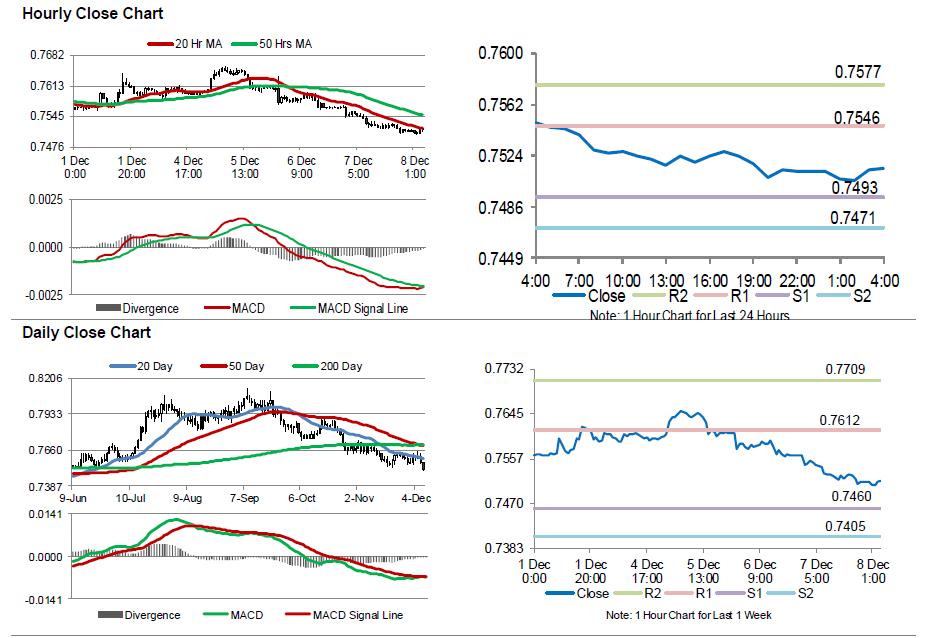

The pair is expected to find support at 0.7493, and a fall through could take it to the next support level of 0.7471. The pair is expected to find its first resistance at 0.7546, and a rise through could take it to the next resistance level of 0.7577.

Next week, traders would focus on a speech by the Reserve Bank of Australia’s (RBA) Governor, Philip Lowe coupled with Australia’s unemployment rate, the NAB business confidence and Westpac consumer confidence data.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.