For the 24 hours to 23:00 GMT, the USD rose 0.48% against the CAD and closed at 1.2854.

The Canadian Dollar lost ground, extending its previous session losses, after the Bank of Canada tempered expectations for an interest rate hike early next year.

In economic news, Canada’s building permits increased 3.5% MoM in October, beating market expectations for an advance of 1.0%. Building permits had risen by a revised 4.9% in the prior month. On the other hand, the nation’s seasonally adjusted Ivey–PMI eased less-than-expected to a level of 63.0 in November, compared to a reading of 63.8 in the previous month, while market participants and anticipated for a fall to a level of 62.5.

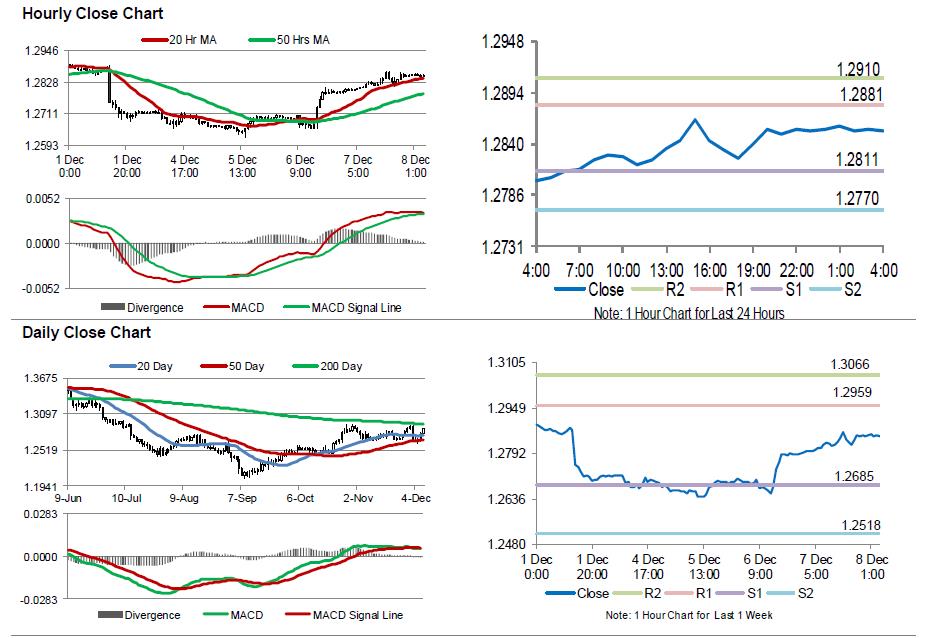

In the Asian session, at GMT0400, the pair is trading at 1.2853, with the USD trading a tad lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2811, and a fall through could take it to the next support level of 1.2770. The pair is expected to find its first resistance at 1.2881, and a rise through could take it to the next resistance level of 1.2910.

Ahead in the day, Canada’s housing starts data for November, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.