For the 24 hours to 23:00 GMT, the AUD slightly declined against the USD and closed at 0.7600.

Yesterday, the OECD stated that the Australian economy will continue to expand at a robust pace, with the labour market strengthening further and added that the Reserve Bank of Australia (RBA) is expected to hike interest rate soon. The organisation predicted Australia’s GDP growth to be 2.5% in 2017, 2.8% in 2018 and 2.7% in 2019.

LME Copper prices declined 1.3% or $92.0/MT to $6800.0/MT. Aluminium prices declined 0.5% or $9.5/MT to $2100.0/MT.

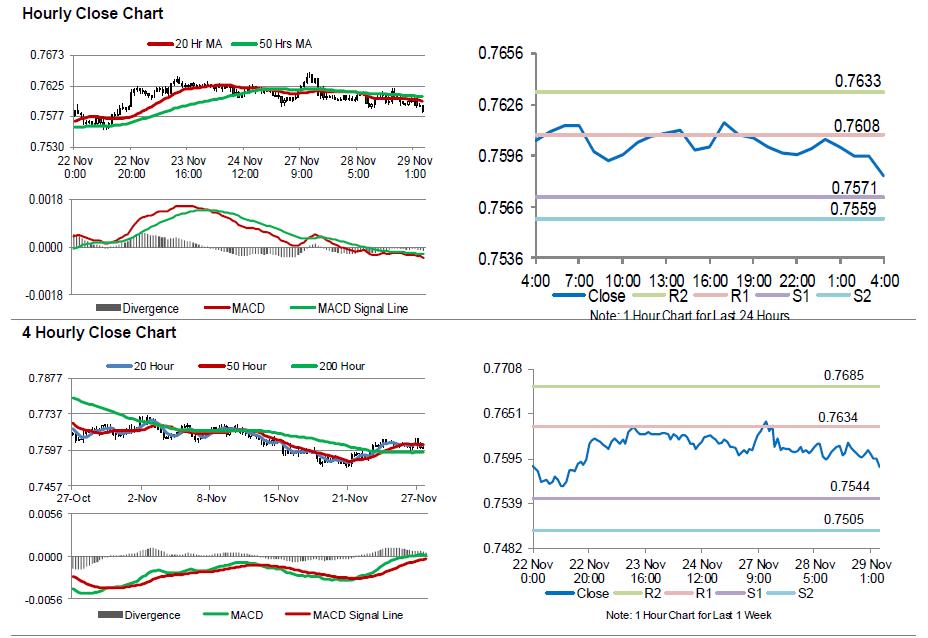

In the Asian session, at GMT0400, the pair is trading at 0.7584, with the AUD trading 0.21% lower against the USD from yesterday’s close.

The pair is expected to find support at 0.7571, and a fall through could take it to the next support level of 0.7559. The pair is expected to find its first resistance at 0.7608, and a rise through could take it to the next resistance level of 0.7633.

Going ahead, Australia’s HIA new home sales and building approvals data, both for October, scheduled to release overnight, would attract a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.