For the 24 hours to 23:00 GMT, the USD rose 0.39% against the CAD and closed at 1.2812.

Yesterday, the OECD projected the Canadian economy to accelerate 3.0% this year, before slowing to 2.1% in 2018 and 1.9% in 2019 as the nation’s central bank withdraws policy stimulus.

Separately, in its latest financial system review, the Bank of Canada (BoC) warned that risks to the Canadian financial system remain elevated mainly due to vulnerabilities created by the nation’s high household debt that are continuing to rise. However, these risks are expected to ease over time as a stronger economy and tighter mortgage requirements would help improve economic conditions.

In the Asian session, at GMT0400, the pair is trading at 1.2819, with the USD trading marginally higher against the CAD from yesterday’s close.

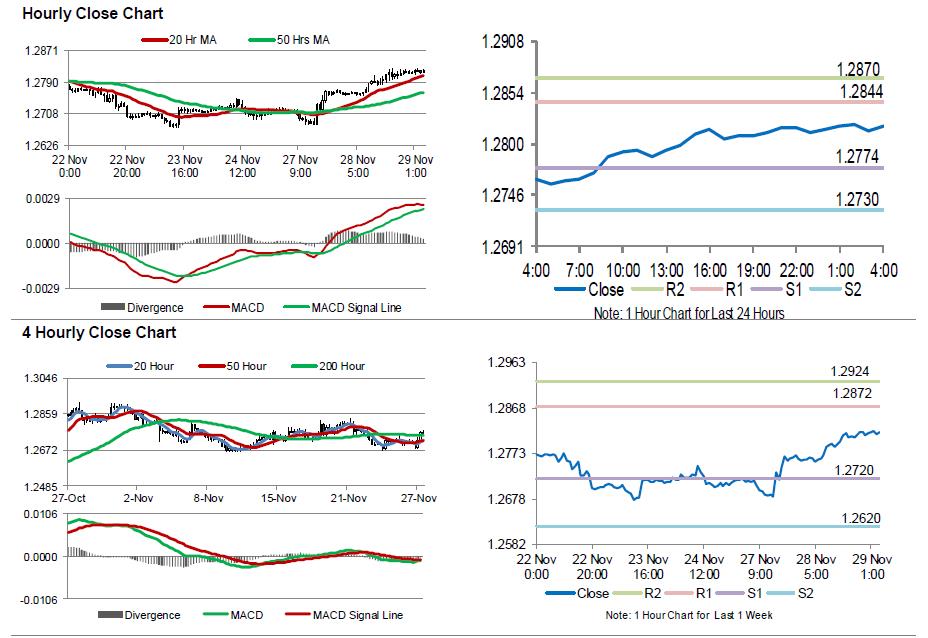

The pair is expected to find support at 1.2774, and a fall through could take it to the next support level of 1.2730. The pair is expected to find its first resistance at 1.2844, and a rise through could take it to the next resistance level of 1.2870.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.