For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.0780.

In economic news, the Euro-zone’s flash consumer confidence index improved more-than-anticipated to a level of -5.0 in March, compared to a level of -6.2 in the previous month, while markets were expecting the index to rise to a level of -5.9.

Separately, the European Central Bank (ECB), in its economic bulletin report, stated that economic recovery in the Euro-zone continues to pick up pace and the recent incoming data point towards robust momentum in the first quarter.

Elsewhere, in Germany, the GfK consumer confidence index unexpectedly fell to a level 9.8 in April, defying market anticipations for it to remain steady at 10.0, as consumers remained concerned about the impact of rising inflation on their incomes.

The US dollar traded higher against most of its major currencies, after data indicated that new home sales in the US jumped 6.1% on a monthly basis, to a level of 592.0K in February, rising by the most since July 2016, suggesting that housing market recovery continued to gain momentum. New home sales registered a revised reading of 558.0K in the prior month, while investors had envisaged it to climb to a level of 564.0K. On the other hand, the nation’s initial jobless claims unexpectedly rose to a level of 258.0K in the week ended 18 March, hitting its highest level in two months, compared to a revised reading of 243.0K in the prior week. Markets participants expected a fall to a level of 240.0K.

Meanwhile, the Federal Reserve Bank of San Francisco President, John Williams, stated that the economy is in a good place and added that he expects the central bank to raise interest rates three or four times this year.

In the Asian session, at GMT0400, the pair is trading at 1.0768, with the EUR trading 0.11% lower against the USD from yesterday’s close.

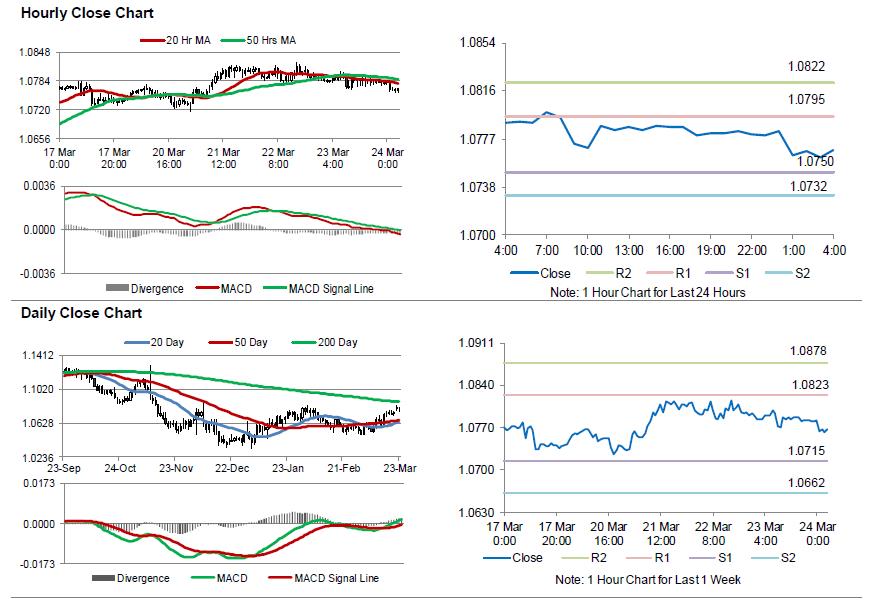

The pair is expected to find support at 1.0750, and a fall through could take it to the next support level of 1.0732. The pair is expected to find its first resistance at 1.0795, and a rise through could take it to the next resistance level of 1.0822.

Moving ahead, investors will closely monitor the flash Markit manufacturing and services PMIs for March across the Euro-zone, slated to release in a few hours. Additionally, the US preliminary Markit manufacturing PMI for March and flash durable goods orders data for February, scheduled to release later today, will pique significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.