For the 24 hours to 23:00 GMT, the GBP rose 0.34% against the USD and closed at 1.2516, on upbeat British retail sales data.

Data revealed that Britain’s retail sales rebounded more-than-anticipated by 1.4% on a monthly basis in February, soothing fears of weaker consumer spending as the nation prepares to leave the European Union. Market expectation was for retail sales to rise 0.4%, compared to a revised drop of 0.5% in the prior month.

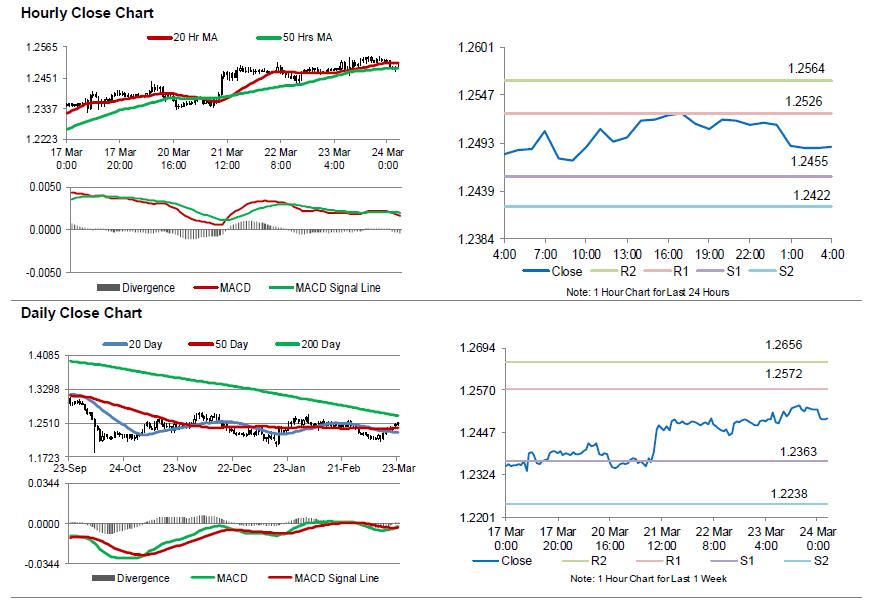

In the Asian session, at GMT0400, the pair is trading at 1.2489, with the GBP trading 0.22% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2455, and a fall through could take it to the next support level of 1.2422. The pair is expected to find its first resistance at 1.2526, and a rise through could take it to the next resistance level of 1.2564.

Going ahead, market participants will focus on UK’s BBA mortgage applications for February, slated to release in a few hours.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.