For the 24 hours to 23:00 GMT, the EUR rose 0.57% against the USD and closed at 1.1787.

The US Dollar declined against a basket of currencies, after the US Federal Reserve (Fed) kept its interest rate decision unchanged.

The Fed, in its interest rate decision, kept its key interest rate unchanged at 0.25%, as widely expected. Further, the Fed reiterated that it remains committed to using its full range of tools to support the US economy and pledged to keep rates low as long as it takes to recover from the pandemic. Moreover, the central bank officials are confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals. On the outlook front, Fed Chair Jerome Powell stated that the path forward for the economy is extraordinarily uncertain and will depend significantly on course of virus.

On the data front, the US pending home sales jumped 16.6% on a monthly basis in June, more than market expectations for a rise of 15.0% and compared to a surge of 44.3% in the previous month. Meanwhile, goods trade deficit narrowed to $70.6 billion in June, compared to a revised deficit of $75.2 billion in the previous month. Meanwhile, the MBA mortgage applications fell 0.8% on a weekly basis in the week ended 24 July 2020, compared to a rise of 4.1% in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1777, with the EUR trading 0.08% lower against the USD from yesterday’s close.

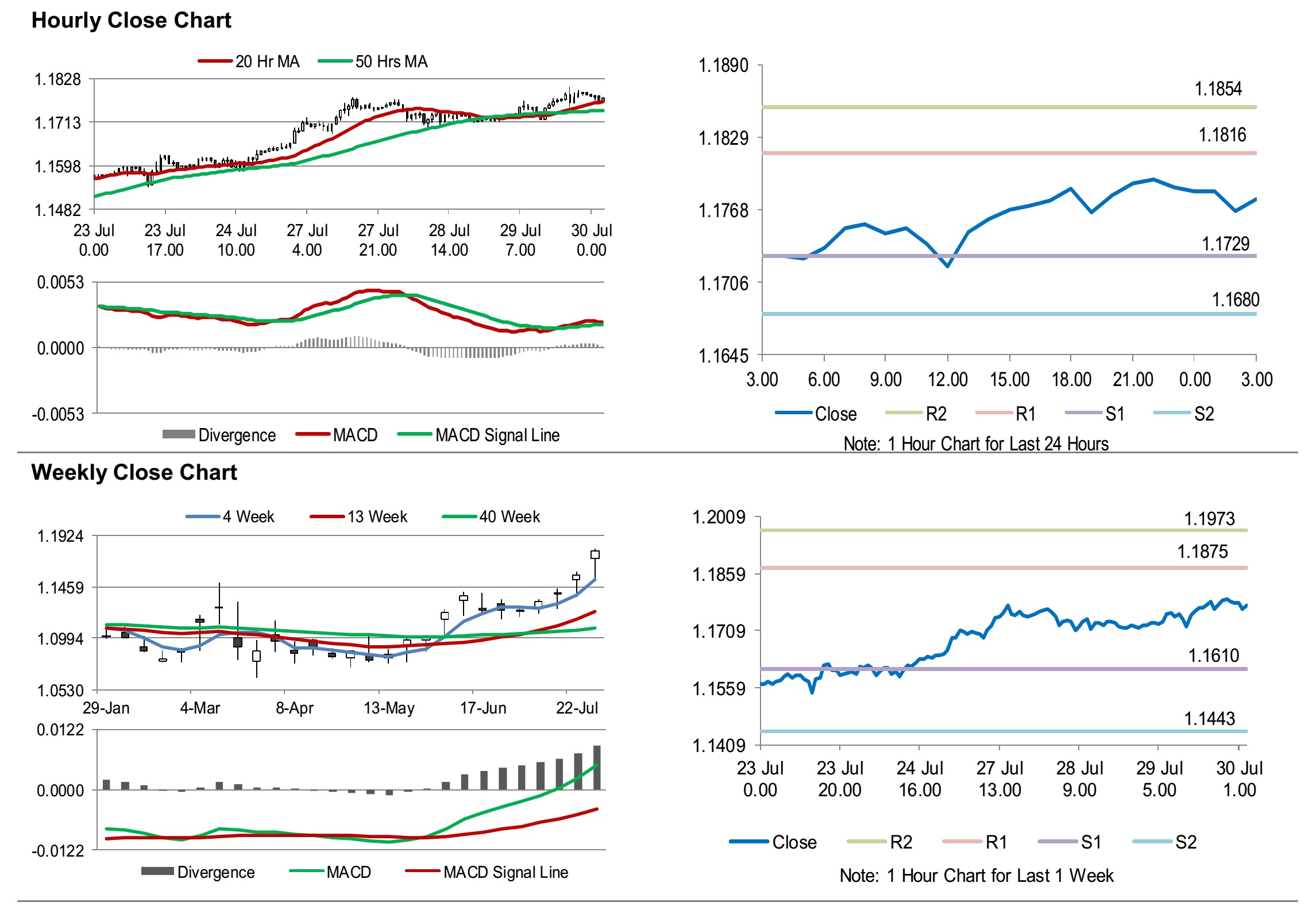

The pair is expected to find support at 1.1729, and a fall through could take it to the next support level of 1.1680. The pair is expected to find its first resistance at 1.1816, and a rise through could take it to the next resistance level of 1.1854.

Going forward, traders would keep a watch on Euro-zone’s service sentiment, consumer confidence, industrial confidence, business climate, and economic sentiment indicator, all for July, followed by the unemployment rate for June along with Germany’s unemployment rate and consumer price index, both for July and gross domestic product (GDP) for 2Q 2020, slated to release in a few hours. Later in the day, the US annualised GDP for 2Q 2020 and initial jobless claims, would garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.