For the 24 hours to 23:00 GMT, the GBP rose 0.48% against the USD and closed at 1.2990.

On the data front, UK’s consumer credit dropped by £0.1 billion in June, less than market expectations for a drop of £2.0 billion and compared to a revised fall of £4.5 billion in the previous month. Meanwhile, mortgage approvals jumped to a three-month high of 40.0K in June, more than market expectations for a rise to a level of 33.9K and compared to a reading of 9.3K in the prior month.

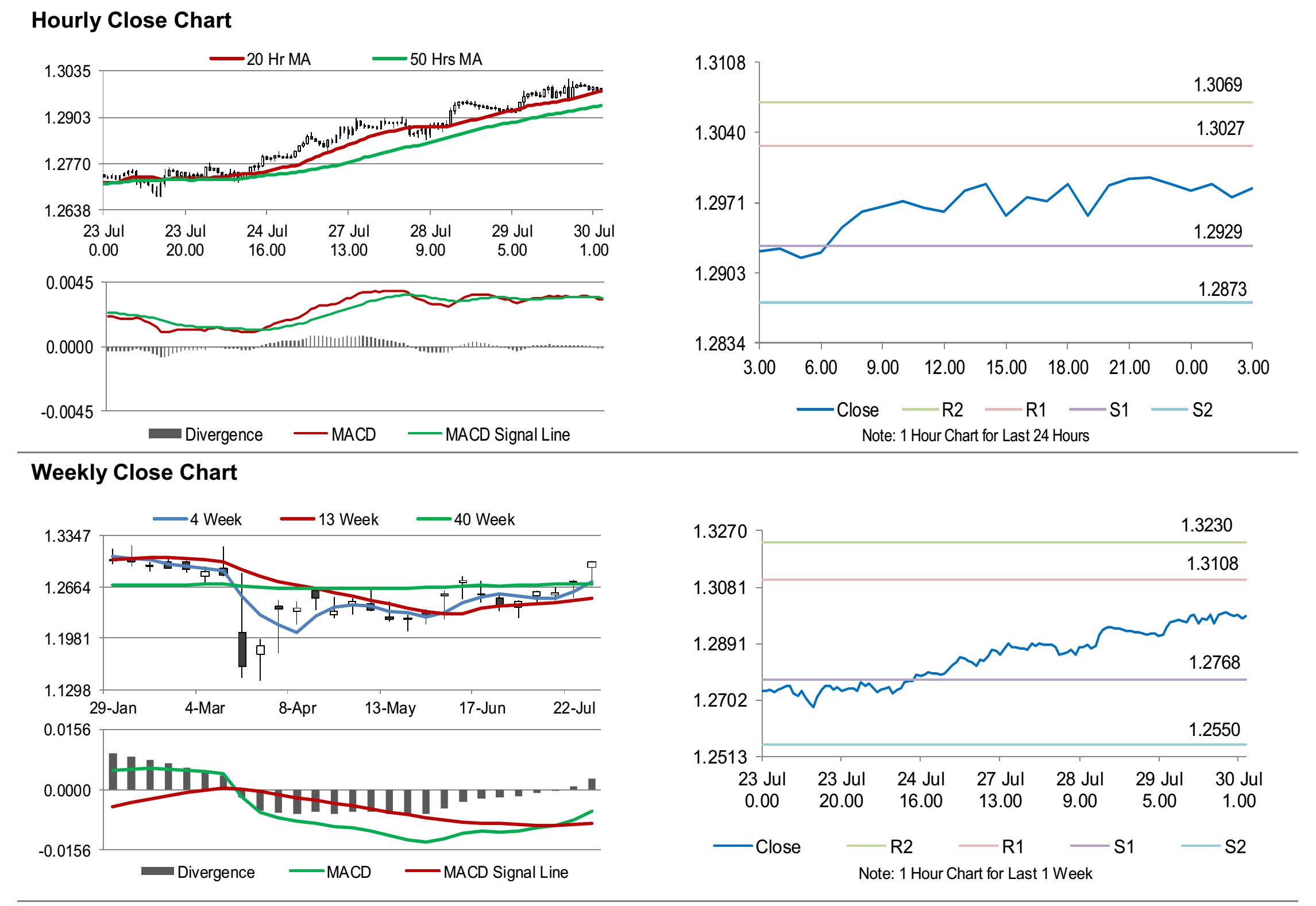

In the Asian session, at GMT0300, the pair is trading at 1.2985, with the GBP trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2929, and a fall through could take it to the next support level of 1.2873. The pair is expected to find its first resistance at 1.3027, and a rise through could take it to the next resistance level of 1.3069.

With no macroeconomic releases in UK today, investor sentiment would be determined by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.