On Friday, the EUR declined 0.53% against the USD and closed at 1.2225.

On the macro front, Germany’s Gfk consumer confidence index rose to a level of 9.0 during January and hit its highest reading in eight years, beating market expectations of an advance to 8.8 and compared to a level of 8.7 recorded in December, suggesting that the Euro-zone’s biggest economy was gaining momentum. Meanwhile, the producer price index remained flat on a MoM basis in November, higher than market expectations for a fall of 0.2%.

On the other hand, the Euro-zone’s seasonally adjusted current account surplus decreased more than expected to €20.5 billion in October, compared to prior month’s surplus of €32.0 billion. Markets were expecting the region to post a current account surplus of €28.0 billion.

Elsewhere, in France, the industrial business climate index remained unchanged at a level of 94.0 in December, compared to market expectations of a rise to 99.0

In the US, the Kansas City Fed manufacturing activity index rose unexpectedly to a level of 8.0 in December, compared to market expectations of a steady reading. In the prior month, the index had recorded a reading of 7.0.

Separately, the Fed’s Richmond President, Jeffrey Lacker, supported the US central bank’s latest policy decision of maintaining a “patient” attitude in raising interest rates. However, he stated that he would look for “little more” data when it comes to actually raising key interest rates.

In the Asian session, at GMT0400, the pair is trading at 1.2246, with the EUR trading 0.17% higher from Friday’s close.

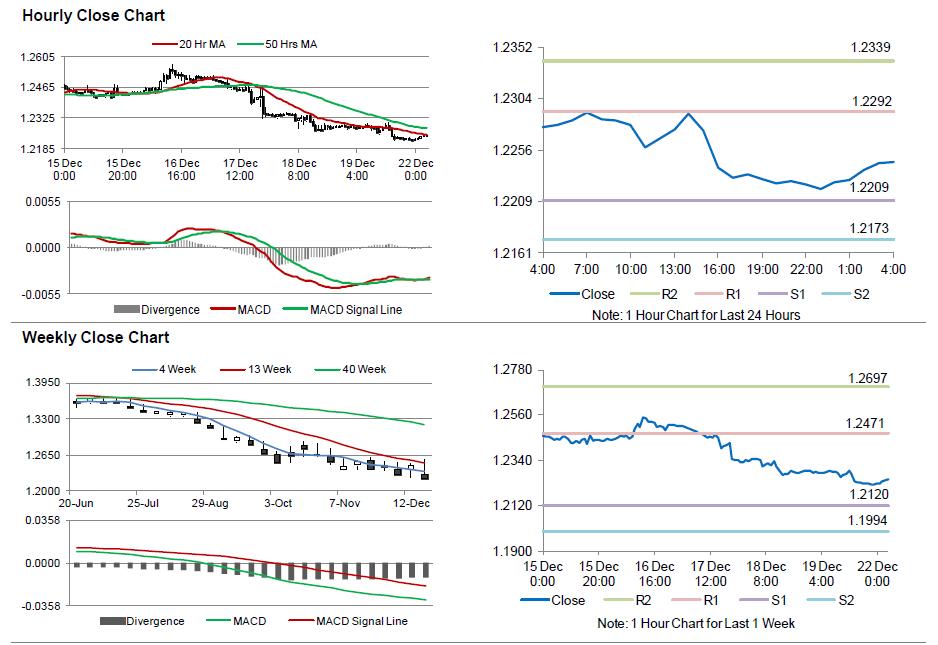

The pair is expected to find support at 1.2209, and a fall through could take it to the next support level of 1.2173. The pair is expected to find its first resistance at 1.2292, and a rise through could take it to the next resistance level of 1.2339.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer confidence data, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.