On Friday, GBP marginally declined 0.24% against the USD and closed at 1.5635.

In economic news, public sector net borrowing in the UK advanced to £13.40 billion in November, as compared to a revised surplus of £6.40 billion in the prior month. Markets were expecting a surplus of £14.80 billion. Meanwhile, the CBI reported that Britain’s CBI distributive trade survey retail sales balance climbed to 61.0% in December, higher than market expectations of a rise to a level of 30.0% and following a level of 27.0% in the previous month.

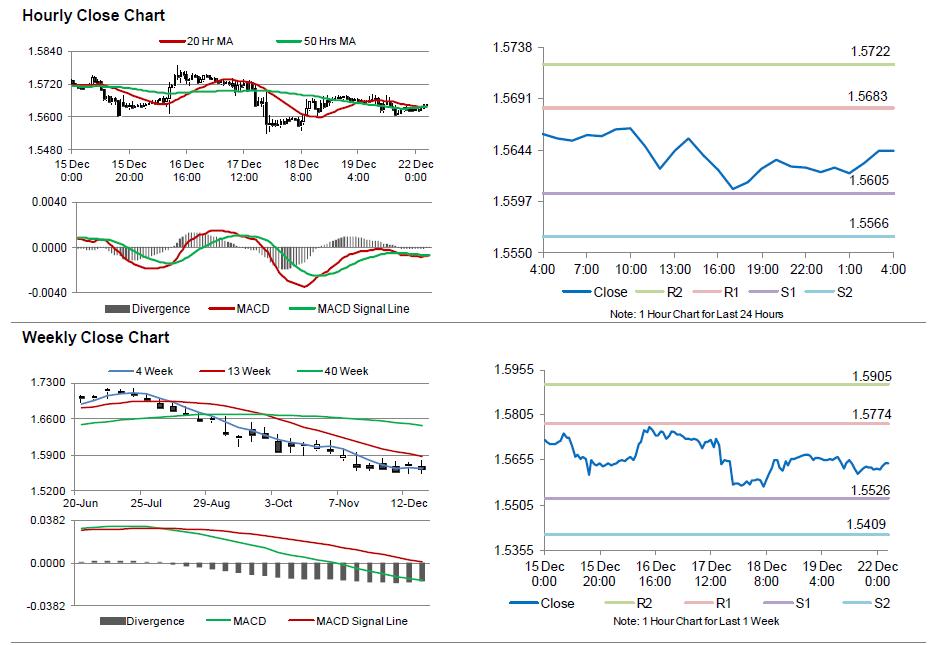

In the Asian session, at GMT0400, the pair is trading at 1.5644, with the GBP trading marginally higher from Monday’s close.

Over the weekend, the BoE’s Monetary Policy Committee member, David Miles stated that at present there was no requirement to insert more stimulus in the UK economy, despite the nation’s inflation falling sharply.

The pair is expected to find support at 1.5605, and a fall through could take it to the next support level of 1.5566. The pair is expected to find its first resistance at 1.5683, and a rise through could take it to the next resistance level of 1.5722.

Amid no economic releases in the UK today, investors look forward to Britain’s crucial GDP data, scheduled for tomorrow.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.