For the 24 hours to 23:00 GMT, the EUR declined 0.21% against the USD and closed at 1.0598.

In economic news, data showed that the Euro-zone’s seasonally adjusted trade surplus widened more-than-expected to a level of €22.7 billion in November, as a surge in exports outpaced a rise in imports. Meanwhile, markets expected the nation’s trade surplus to widen to a level of €20.8 billion, following a revised trade surplus of €19.9 billion in the previous month.

Meanwhile, the International Monetary Fund (IMF) revised up its growth forecast for the Euro-zone by 0.1% to 1.6% for 2017 and 2018.

Additionally, the Fund reported that the US economy is projected to grow 2.3% and 2.5% in 2017 and 2018 respectively, up by 0.1% and 0.4%, reflecting an expected boost from the economic policies of the US President-elect Donald Trump. Moreover, the IMF left global growth forecasts unchanged at 3.4% and 3.6% for 2017 and 2018 respectively.

In the Asian session, at GMT0400, the pair is trading at 1.0624, with the EUR trading 0.25% higher against the USD from yesterday’s close.

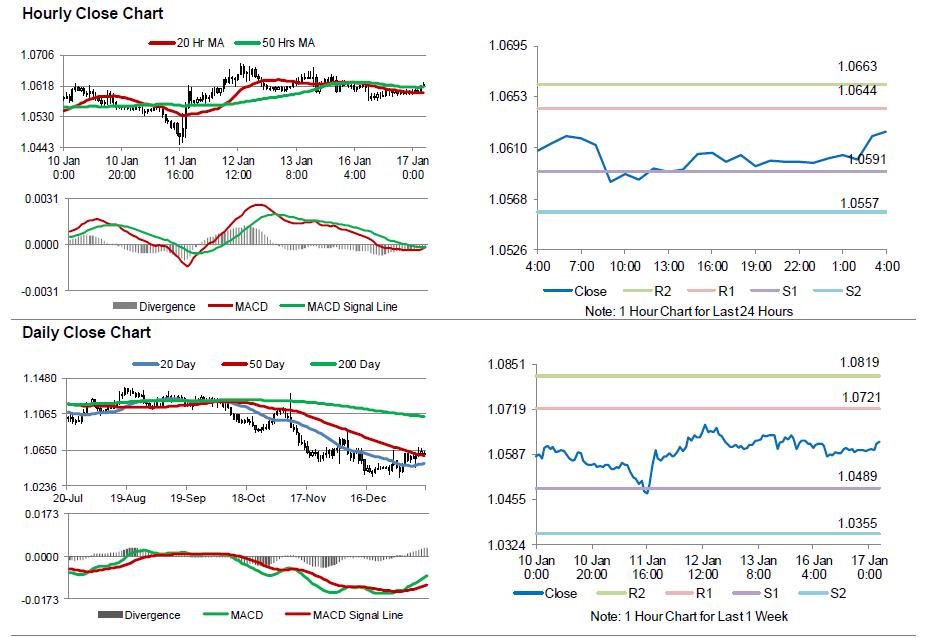

The pair is expected to find support at 1.0591, and a fall through could take it to the next support level of 1.0557. The pair is expected to find its first resistance at 1.0644, and a rise through could take it to the next resistance level of 1.0663.

Trading trends in the Euro today are expected to be determined by the release of ZEW survey of economic sentiment index for January across the Euro-zone, scheduled in a few hours, which is expected to show a further improvement in investor sentiment. Additionally, the US New York Empire State manufacturing data for January, slated to release later today, will be on investor’s radar.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.