For the 24 hours to 23:00 GMT, the GBP declined 0.07% against the USD and closed at 1.2018.

Yesterday, the Bank of England (BoE) Governor, Mark Carney, in a speech at the London School of Economics, stated that he expects growth in the British economy to slow this year as a surge in inflation will weigh on wages and consumer spending. Further, he stated that UK growth was relying more heavily on consumer spending, rather than investment or exports.

Separately, the IMF upgraded its forecasts for the UK economy this year, amid fresh signs that businesses and consumers have shrugged off uncertainty created by the historic Brexit vote. The Fund now expects UK economy to grow 1.5% this year, up from a previous estimate of 1.1%. However, growth forecast for 2018 was revised down from 1.7% to 1.4%.

In the Asian session, at GMT0400, the pair is trading at 1.2069, with the GBP trading 0.42% higher against the USD from yesterday’s close, ahead of a crucial Brexit speech by the UK Prime Minister, Theresa May, due later in the day.

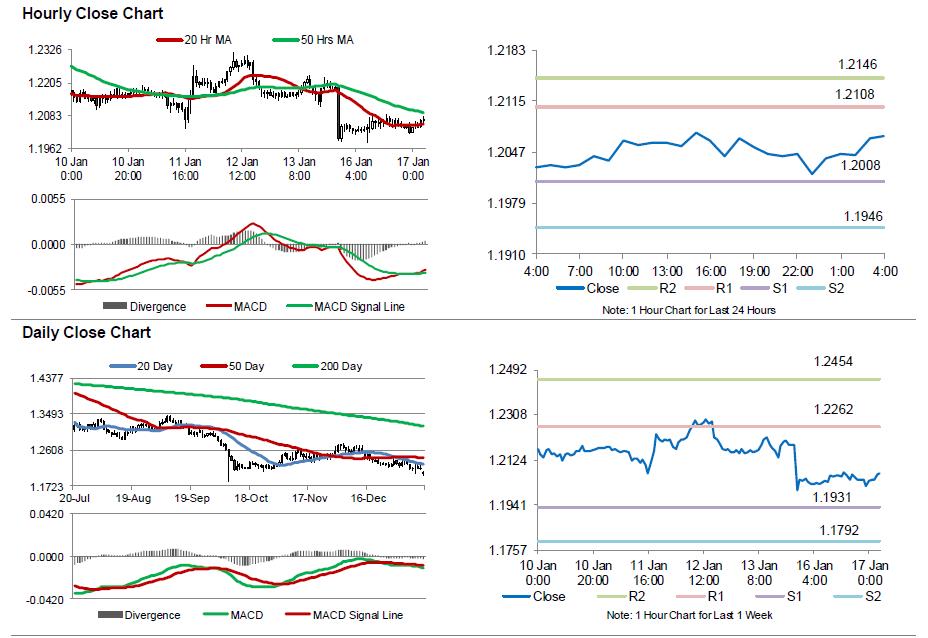

The pair is expected to find support at 1.2008, and a fall through could take it to the next support level of 1.1946. The pair is expected to find its first resistance at 1.2108, and a rise through could take it to the next resistance level of 1.2146.

Ahead in the day, all eyes will be on a speech by the Britain’s Prime Minister, Theresa May, as she is expected to outline her Brexit plans. Additionally, investors will focus on UK’s consumer price index for December, set to release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.