For the 24 hours to 23:00 GMT, the EUR rose 0.18% against the USD and closed at 1.0554, after the Euro-zone’s final consumer price index (CPI) rose 1.8% on an annual basis in January, confirming the preliminary print, driven by high energy prices. In the previous month, the CPI had climbed 1.1%. Meanwhile, on a monthly basis, final consumer prices in the common currency region dropped 0.8% in January, in line with market estimates.

Elsewhere, in Germany, the Ifo business climate index unexpectedly advanced to a level of 111.0 in February, suggesting that firms are expressing more optimism despite heightened political risks in Europe. Markets expected the index to fall to a level of 109.6, after recording a level of 109.8 in the prior month. Moreover, the nation’s Ifo current assessment index surprisingly jumped to a level of 118.4 in February, notching its highest level in more than five years, thus highlighting that businesses are increasingly confident about the months ahead. The index had registered a reading of 116.9 in the prior month, while investors had envisaged for a fall to a level of 116.7. Also, the Ifo business expectations index unexpectedly inched higher to a level of 104.0 in February, defying consensus for a fall to a level of 103.0 and compared to a level of 103.2 in the prior month.

The greenback traded mixed against its key counterparts, after minutes of the Federal Reserve’s (Fed) recent monetary policy meeting showed concerns over considerable uncertainties surrounding fiscal policy and a strong greenback.

Minutes indicated that most board members expressed the view that it might be appropriate to raise interest rates “fairly soon”, provided labour market data and inflation were in line or stronger than expectations. However, some policymakers wanted the central bank to go slow on raising rates, given uncertainties about the new US President, Donald Trump’s fiscal policies, while some expressed concerns that a strong US Dollar could hurt the US economy.

Meanwhile, the Fed Governor, Jerome Powell, stated that an interest rate hike would be on the table at the Fed’s next meeting in March, if the economy continues on the growth-track.

On the macro front, the US existing home sales surged to a ten-year high level, after it rebounded 3.3% on monthly basis, to a level of 5.69 million in January, beating market expectations for a rise to a level of 5.54 million and following a revised level of 5.51 million in the prior month. On the other hand, the nation’s MBA mortgage applications fell 2.0% in the week ended 17 February 2017, after dropping 3.7% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.0565, with the EUR trading 0.1% higher against the USD from yesterday’s close.

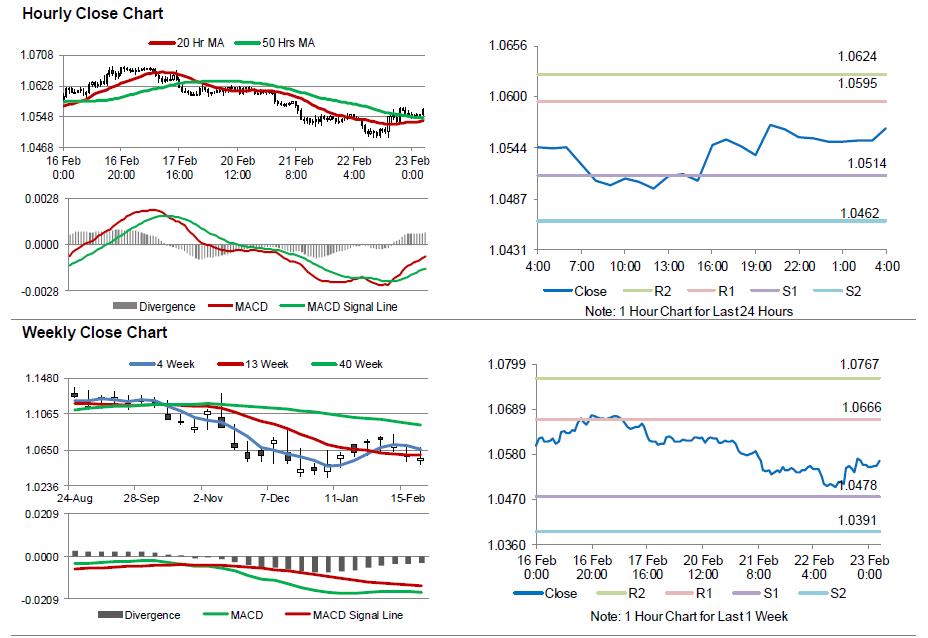

The pair is expected to find support at 1.0514, and a fall through could take it to the next support level of 1.0462. The pair is expected to find its first resistance at 1.0595, and a rise through could take it to the next resistance level of 1.0624.

Trading trend in the Euro today is expected to be determined by the release of Germany’s final 4Q GDP data along with the GfK consumer confidence index for March, both scheduled to release in a few hours. Moreover, the US weekly jobless claims and house price index for December, set to release later today, would also attract significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.