For the 24 hours to 23:00 GMT, the GBP declined 0.16% against the USD and closed at 1.2456, after Britain’s gross domestic product (GDP) data indicated that UK’s annual growth rate was revised down in the final three-months of 2016.

The second estimate of GDP revealed that UK’s economy expanded less-than-expected by 2.0% on an annual basis in the fourth quarter, compared to an advance of 2.2% in the preliminary figures and after recording an expansion of 2.2% in the prior quarter. Meanwhile, on a quarterly basis, the GDP grew 0.7% in the fourth quarter of 2016, revised up from the preliminary estimate of 0.6%, mainly due to a stronger performance by the manufacturing industry. GDP had advanced by 0.6% in the previous quarter.

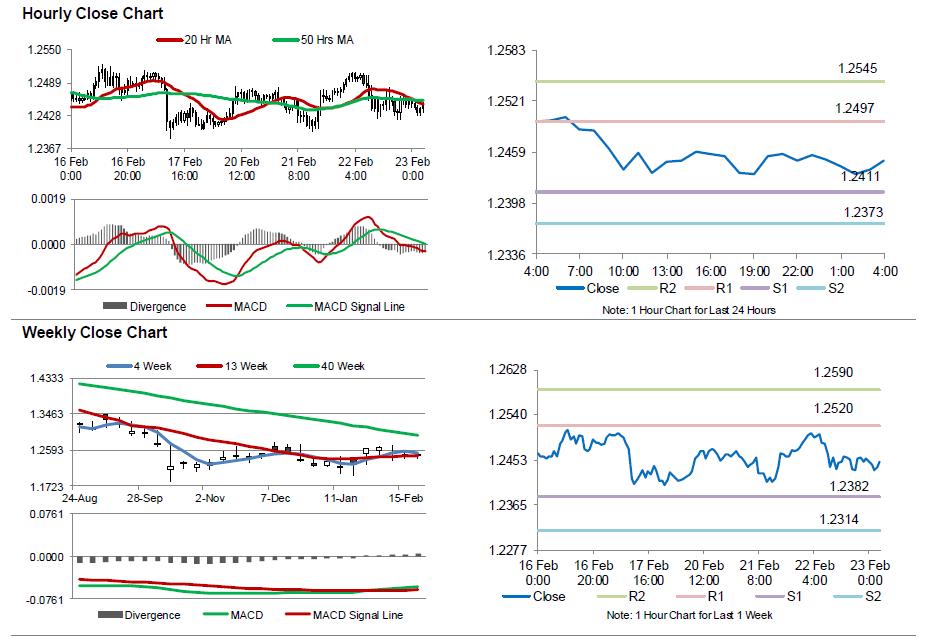

In the Asian session, at GMT0400, the pair is trading at 1.2449, with the GBP trading 0.06% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2411, and a fall through could take it to the next support level of 1.2373. The pair is expected to find its first resistance at 1.2497, and a rise through could take it to the next resistance level of 1.2545.

With no major economic releases in UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.