For the 24 hours to 23:00 GMT, the EUR declined 2.85% against the USD and closed at 1.0668.

On the macro front, Euro-zone’s seasonally adjusted construction output rose 3.6% on a monthly basis in January, surpassing market forecast for a rise of 0.3% and compared to a revised fall of 1.8% in the previous month. In Germany, the preliminary Ifo business climate index declined to a level of 87.7 in March, as the spread of coronavirus took its toll on economic activity and registering its weakest reading since August 2009. In the previous month, the index had recorded a revised level of 96.0 in the previous month. Additionally, the nation’s flash Ifo current assessment index dropped to 93.8 in March, compared to a revised level of 99.0 in the previous month. Moreover, the preliminary Ifo business expectations index fell to a reading of 82.0 in March, compared to a revised level of 93.2 in the previous month.

In US, current account deficit narrowed to $109.8 billion in the fourth quarter of 2019, compared to a revised deficit of $125.4 billion in the prior quarter. Market participants had expected the nation to post a current account deficit of $109.0 billion and. Additionally, the Philadelphia Fed Manufacturing index unexpectedly fell to -12.7 in March, compared to a level of 36.7 in the previous month. Moreover, initial jobless claims advanced to 281.0K on a weekly basis in the week ended 13 March 2020, more than market consensus for a rise to a level of 220.0K and compared to a reading of 211.0K in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0737, with the EUR trading 0.65% higher against the USD from yesterday’s close.

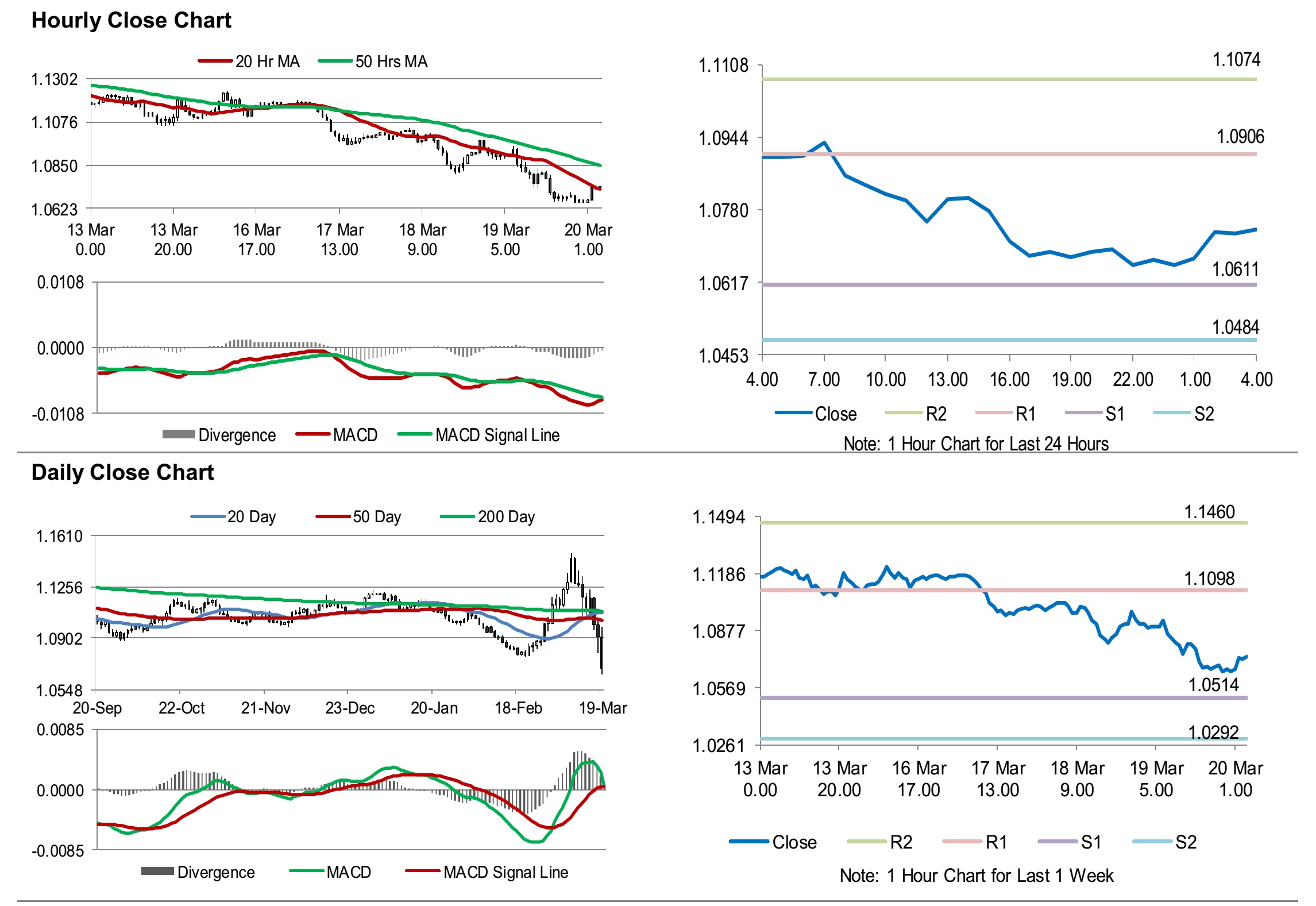

The pair is expected to find support at 1.0611, and a fall through could take it to the next support level of 1.0484. The pair is expected to find its first resistance at 1.0906, and a rise through could take it to the next resistance level of 1.1074.

Moving forward, participants would keep a watch on Euro-zone’s current account for January, along with Germany’s producer price index for February, slated to release in a few hours. Later in the day, US existing home sales for February, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.