For the 24 hours to 23:00 GMT, the GBP declined 12.15% against the USD and closed at 1.1445.

The Bank of England (BoE), in its monetary policy meeting, slashed its benchmark interest rate by 15bps to 0.1%, in an effort to offset the economic impact of the coronavirus outbreak. Moreover, the central bank announced that it would make additional bond purchases worth GBP200bn effectively printing new money to push into the financial system.

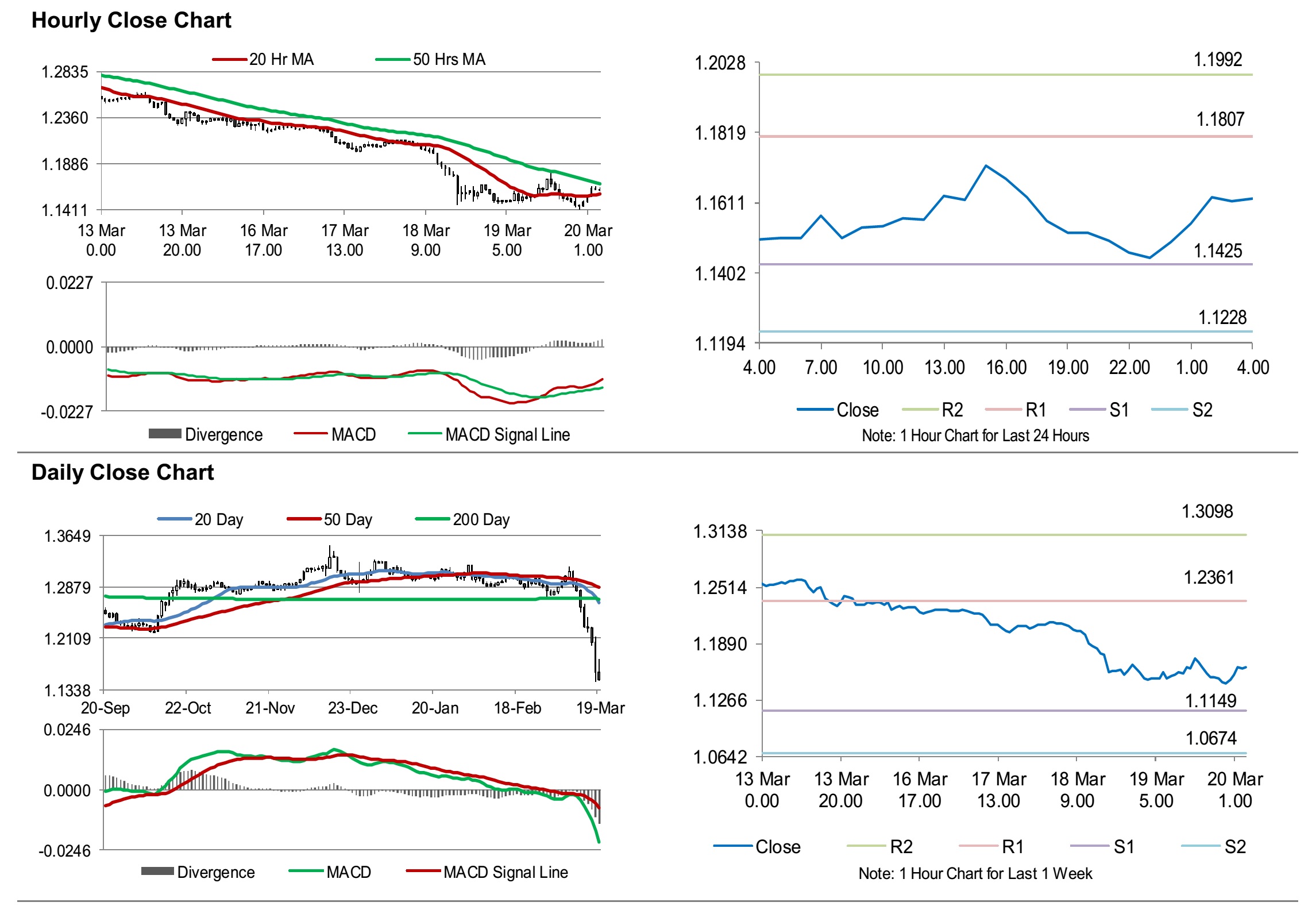

In the Asian session, at GMT0400, the pair is trading at 1.1623, with the GBP trading 1.56% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1425, and a fall through could take it to the next support level of 1.1228. The pair is expected to find its first resistance at 1.1807, and a rise through could take it to the next resistance level of 1.1992.

Looking forward, traders would keep a close watch on Britain’s public sector net borrowing for February, followed by consumers inflation expectations, slated to release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.