For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.2311, after the European Central Bank’s (ECB) President, Mario Draghi, stuck to his pledge of pouring money into the Euro-zone economy.

The ECB Chief cautioned that the slack in the Euro-zone’s economy may be wider than initially estimated and this could act as a temporary drag on inflation growth. Further, Draghi emphasised the need to maintain the central bank’s ultra-loose monetary policy support despite acknowledging the robust and broad based economic growth across the Euro-zone.

In the US, data showed that new home sales unexpectedly fell by 7.8% on monthly basis to a level of 593.0K in January, hitting its lowest level since August 2017, thus stoking concerns that the nation’s housing market is losing momentum. New home sales had registered a revised reading of 643.0K in the prior month, while markets were anticipating for an increase to a level of 647.0K.

Other economic data revealed that the US Dallas Fed manufacturing business index surprisingly advanced to a level of 37.2 in February, defying market consensus for a drop to a level of 30.0. The index had registered a reading of 33.4 in the previous month. On the other hand, the nation’s Chicago Fed national activity index registered an unexpected drop to a level of 0.12 in January, compared to a revised reading of 0.14 in the previous month. Markets were expecting the index to rise to a level of 0.20.

In the Asian session, at GMT0400, the pair is trading at 1.2326, with the EUR trading 0.12% higher against the USD from yesterday’s close.

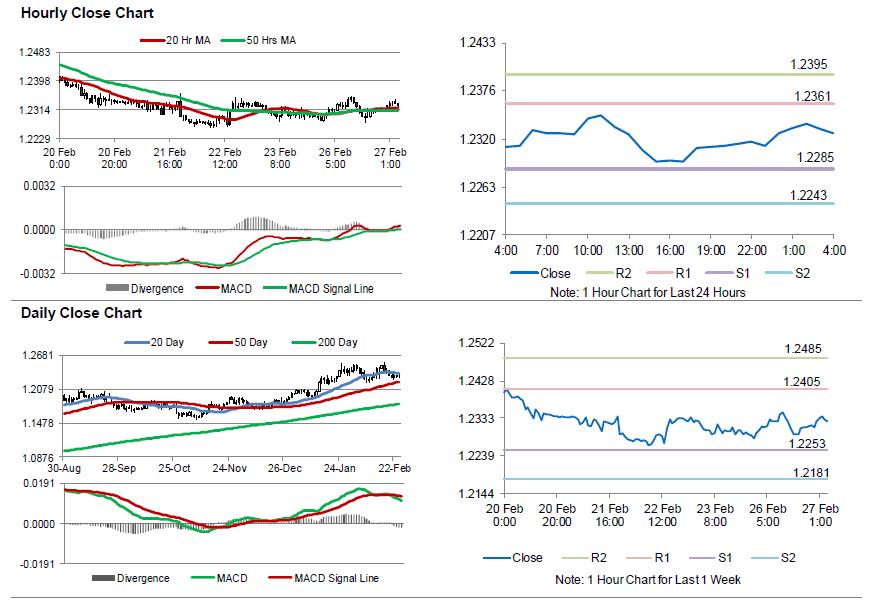

The pair is expected to find support at 1.2285, and a fall through could take it to the next support level of 1.2243. The pair is expected to find its first resistance at 1.2361, and a rise through could take it to the next resistance level of 1.2395.

Going ahead, traders would closely monitor the Euro-zone’s final consumer confidence index for February, slated to release in a few hours. Moreover, Germany’s flash inflation numbers for February, set to release later in the day, will be on investors’ radar. Later in the day, market participants would look forward to the Federal Reserve Chairman, Jerome Powell’s first congressional testimony to get better insights on the future pace of monetary policy tightening. Moreover, the US advance goods trade balance, flash durable goods orders, both for January as well as the CB consumer confidence index for February, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.