For the 24 hours to 23:00 GMT, the GBP declined 0.26% against the USD and closed at 1.3963.

On the macro front, data showed that UK’s BBA mortgage approvals jumped more-than-expected to a level of 40.12K in January, rising for the first time in 4 months. In the previous month, mortgage approvals had recorded a revised reading of 36.09K, while investors had envisaged for an advance to a level of 37.00K.

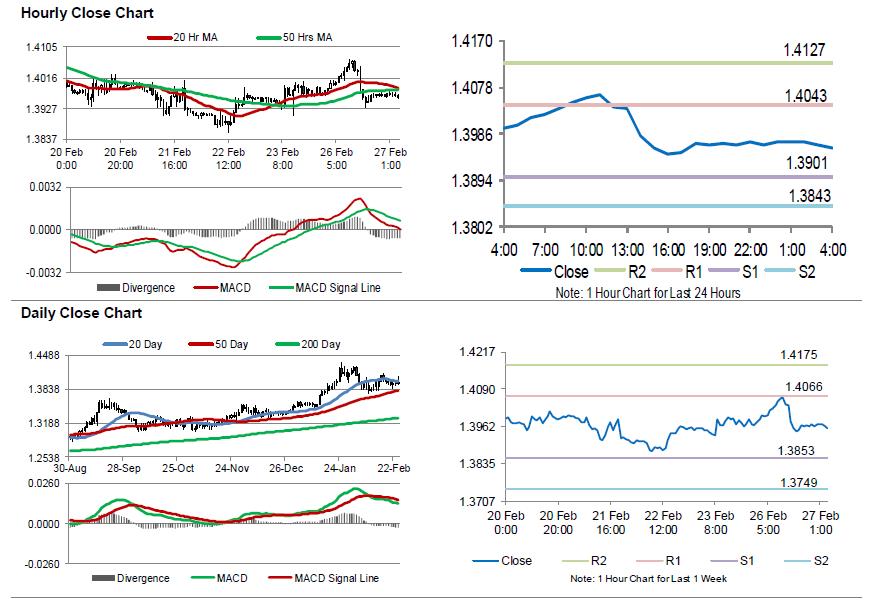

In the Asian session, at GMT0400, the pair is trading at 1.3958, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3901, and a fall through could take it to the next support level of 1.3843. The pair is expected to find its first resistance at 1.4043, and a rise through could take it to the next resistance level of 1.4127.

Moving ahead, investors would eye UK’s GfK consumer confidence index for February, set to release overnight.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.