For the 24 hours to 23:00 GMT, the EUR declined 0.48% against the USD and closed at 1.1415.

Macroeconomic data indicated that the Euro-zone’s seasonally adjusted industrial production rose by 1.3% on a monthly basis in May, posting its largest increase in six months, thus confirming that the region’s economy remains on course for stronger growth in the second quarter. In the prior month, industrial production had recorded a revised rise of 0.3%, while markets anticipated for a gain of 1.0%.

Yesterday, the Federal Reserve (Fed) Chairwoman, Janet Yellen, in a testimony before the House Financial Services Committee, expressed optimism over the US economy and emphasised the central bank’s gradual approach on monetary policy trajectory over next few years, noting that interest rates may not have to rise much further to meet the Fed’s goals. Moreover, she added that the central bank would proceed with the unwind of its balance sheet this year, on the back of a healthy labour market.

Separately, the Fed’s Beige Book report revealed that the US economy saw “slight to moderate” growth from late May through June. Further, it reported that companies are finding it difficult to fill open positions due to a shortage of qualified candidates and that labour markets tightened further, but price pressures were largely held in check.

On the data front, mortgage applications in the US dropped 7.4% in the week ended 07 July 2017, following a gain of 1.4% in the previous week.

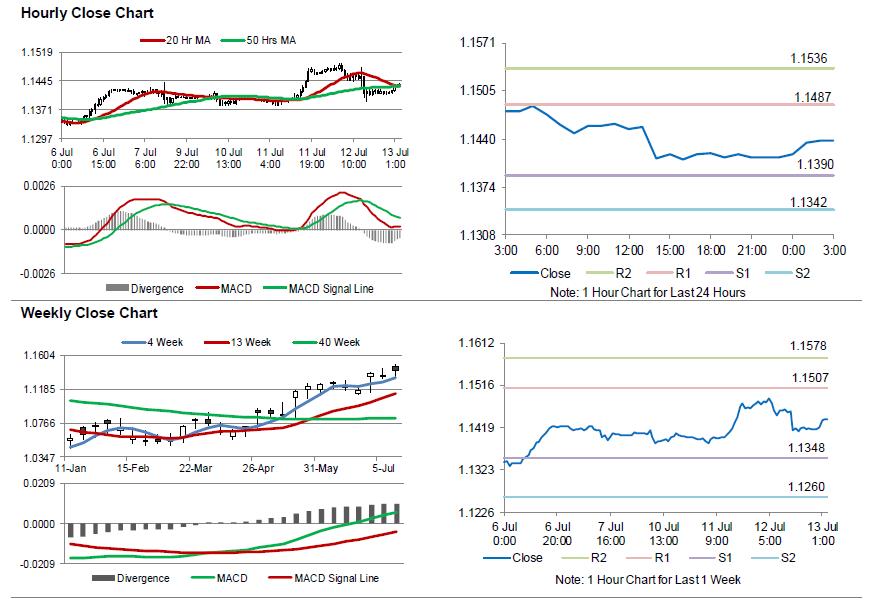

In the Asian session, at GMT0300, the pair is trading at 1.1437, with the EUR trading 0.19% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1390, and a fall through could take it to the next support level of 1.1342. The pair is expected to find its first resistance at 1.1487, and a rise through could take it to the next resistance level of 1.1536.

Moving ahead, investors will focus on Germany’s final consumer price inflation data June, slated to release in a few hours. Moreover, a testimony by the Fed Chair, Janet Yellen and the US weekly jobless claims data, later in the day, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.