For the 24 hours to 23:00 GMT, the GBP rose 0.29% against the USD and closed at 1.2891, after unemployment rate in the UK dipped to a 42-year low in the three months to May.

Britain’s ILO unemployment rate unexpectedly dropped to 4.5% in the three months ended May, hitting its lowest level since 1975, pointing to a healthy labour market. Markets anticipated the nation’s unemployment rate to remain steady at 4.6%. Meanwhile, the nation’s average earnings including bonus advanced 1.8% in the March-May period, at par with market expectations, following a gain of 2.1% in the February-April period, suggesting anaemic wage growth.

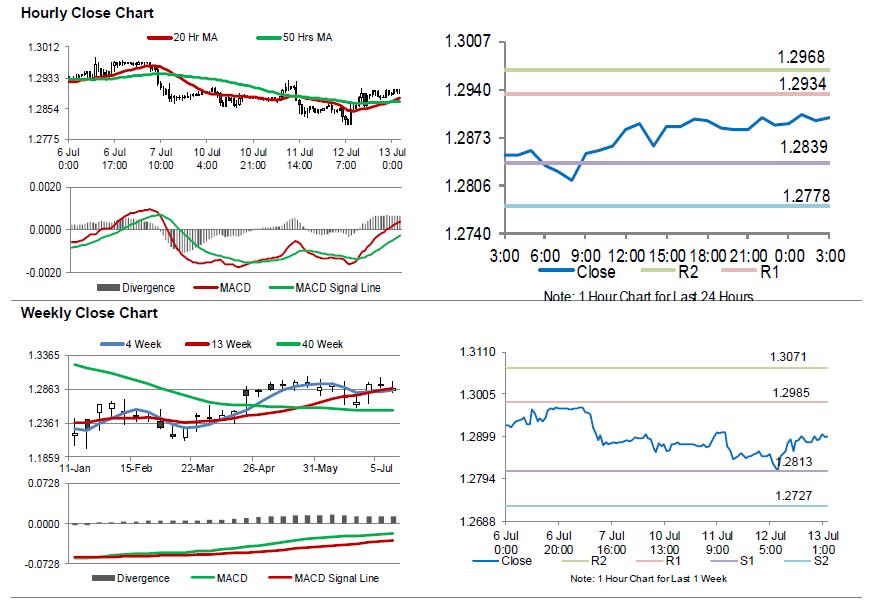

In the Asian session, at GMT0300, the pair is trading at 1.2900, with the GBP trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 1.2839, and a fall through could take it to the next support level of 1.2778. The pair is expected to find its first resistance at 1.2934, and a rise through could take it to the next resistance level of 1.2968.

Going ahead, traders will look forward to the Bank of England’s (BoE) credit conditions survey report, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.